Greece seems to be finding that it has fewer and fewer options to address its financial crisis. It is becoming increasingly clear that Greece will need another massive bailout in order to remain afloat, but European finance ministers have indicated that the bailout must be accompanied by a series of tough choices.

CNN explains:

Greece has to raise 50 billion euros ($71 billion) through privatization by 2015, Eurogroup members said.

It also has to push through tough budget-cutting measures, they said, despite widespread protests in the country that forced a government reshuffle last week.

Officials in Greece, in order to raise the necessary funds for the bailout, have proposed selling government assets which include real estate, airports, highways, companies, and banks.

The Blaze adds:

In addition to securing much-needed loan monies, the government has proposed cutting the public-sector workforce by 150,000, changing working hours and wages and changing benefits found under the nation’s social safety net. These reforms, the government claims, are essential to prevent the Greek government from defaulting. The public, of course, isn’t happy about the impending changes.

The proposal was made by European finance ministers at a two-day meeting in Luxembourg.

Still, European leaders have not reached an agreement regarding Greece’s bailout package, even as members of the International Monetary Fund have warned that without the bailout, Greece will undergo even further economic turmoil.

President of Eurozone Finance Ministers Jean-Claude Juncker asserts that European leaders are not comfortable releasing more funds to Greece until the country proves itself to be committed to asset sales and spending cuts.

“As the vote by the Greek parliament has been fixed for the end of June, we cannot make an engagement without knowing if the Greek parliament [will] endorse the commitments made by Greece,” said Juncker.

The Wall Street Journal reports:

The Ministers deferred any final decision on the installment payment until early July, after the vote in Parliament, and showed modest signs of progress toward a broader agreement for a bigger package of aid to Greece for coming years. They set another meeting for July 3.

Members of the Group of Seven — the United States, Germany, Italy, Japan, the United Kingdom, France, and Canada — have expressed apprehension at the notion of bailing out Greece yet again. Members fear that Greece will not be able to successfully deliver on its promise to restructure its economy, upon which the bailout is contingent.

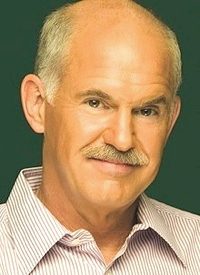

The vote on the package of austerity measures will be taking place at the end of the month, but Prime Minister George Papandreou (pictured above) must first face a challenging vote of confidence in his new ministers this week. As Papandreou’s party retains an extremely small majority in the Parliament, the vote is certainly intimidating.

Papandreou asserts that he is working to achieve “the widest possible consensus” in Parliament for the budget cuts laid out by European authorities. He adds that Greece is facing “difficult and complicated” negotiations over the package.

Despite the difficulties of the vote, the bottom line is that passage of the austerity measures is a “necessary condition” for more aid, declared European Commission President José Manuel Barroso.

European leaders used Greece’s predicament to outline how they would increase the size of the European Union’s current temporary bailout fund, and decided on the final form of an agreement on the creation of a new bailout fund. The new fund must be ratified by national parliaments.

The Wall Street Journal reports:

One change was a pleasant surprise for the EU’s weakest countries: Finance ministers dropped their demand that new lending from the forthcoming European Stability Mechanism bailout fund be given preferred-creditor status that would ensure it is paid back before other, private lenders.

The decision, implying a concession from Germany, applies only to Greece, Ireland and Portugal, the three countries already being bailed out.

Those countries had warned that the preferred-creditor demand would make it much harder for the countries to return to the private markets to raise cash — which is the point of the bailout exercise.

Though the European Stability Mechanism will not be established until 2013, the bailout deals for Portugal, Greece, and Ireland will not have the preferred-creditor features.

Irish Finance Minister Michael Noonan said of the ESM, “The change makes it possible now for Ireland to go back into the markets and be sure that there are people there who will lend us money.”

Despite the measures being adopted as a means to target the economic plight of European nations, The Daily Mail asserts that European countries should take this opportunity to rethink the euro. In an article entitled, “Why won’t the EU’s leaders accept the euro is fatally flawed — and allow Greece to go bust?” Daniel Hannan observed:

Greece’s debt is now growing faster than its economy; making it a mathematical certainty that it will not pay its creditors. The international markets know it: [L]ong-term Greek government debt is trading at around two-thirds of its nominal value.

Indeed, the only people who still believe (or pretend to believe) that Greece can remain solvent are the eurozone finance ministers, who have just agreed [to] another bailout.

In a statement of stunning complacency, they praised Athens for a “significant and necessary adjustment effort” which would contribute to “avoiding a default.”

They took the same line a year ago, when they offered Greece €110?billion to get through what they insisted was simply a short-term cash crisis.

Now, despite those assurances, they are set to release another €80?billion.

Such bailouts are not useless, but actively harmful: [T]he last thing an over-indebted country needs is more loans.

Analysts cannot help but note the similarities between the obliviousness of the European leaders who ignore the fundamental flaws of the euro and that of American lawmakers who assert that reform to entitlement programs such as Social Security, Medicare, and Medicaid is not necessary. Some actually claim that the entitlement programs are sustainable, despite evidence to the contrary.

If the United States refuses to see in Greece its own future, it is doomed to become Greece, and perhaps sooner than it thinks.