As Election Day —Tuesday, November 3 — draws closer, more attention is being paid to the Democrat Party’s presumptive presidential candidate Joe Biden and his plans to tax and spend the country into oblivion.

The Tax Foundation and the Tax Policy Center have analyzed the impact Biden’s plans would have on the economy, the deficits, the national debt, and the average taxpayer.

The Tax Foundation said that, given the chance, Biden (along with a compliant and Democrat-controlled House and Senate starting January 2021) would raise income and payroll taxes which would reduce the gross domestic product by 1.5 percent. That means that growth of the economy, which averaged close to three percent each year under President Trump, would be cut in half.

The estimated $4 trillion in new revenues over the next 10 years would fade into relative insignificance in light of the national debt, which is rapidly approaching $30 trillion.

He would raise Social Security taxes on anyone earning more than $400,000 a year; he would tax long-term capital gains at the same rate as income taxes; he would limit itemized deductions (equivalent to a tax increase); he would increase corporate income-tax rates from 21 percent currently to 28 percent; he would require every corporation with profits of $100 million or more to pay at least 15 percent in income taxes regardless of any tax breaks Congress might have previously allowed to favor critical industries such as oil and gas and real estate development; and he would double the income-tax rate on foreign-earned income.

The slowdown in the economy would, according to the foundation, cost the economy nearly 600,000 jobs.

The Tax Policy Center comes up with nearly the same conclusion: Taxes would go up on everyone, not just the so-called wealthy, thanks to the increased costs borne by corporations, and the economy would slow down to less than two percent growth per year. In addition, said the Center, “Biden’s spending proposals would have important distributional and economic effects … including changes to Social Security benefits, federal financial aid for postsecondary students, and housing assistance as well as creating a public insurance option” under ObamaCare.

Jared Dillian, an investment strategist at Mauldin Economics, said that Biden’s plan would “take a tax code that is already steeply progressive and make it even more progressive … [which] would clearly discourage savings, investment, and business formation … causing lasting economic damage.”

He concluded: “The U.S. has enjoyed strong rates of business formation, but that wouldn’t last very long if Biden becomes president and his tax plan becomes law.”

That’s just the “revenue-raising” part of Biden’s plan. He has big spending plans as well, including a “green” energy plan that would cost $2 trillion, and a revised healthcare plan that would cost even more: $2.25 trillion.

Put all together, then, Biden’s negative impact on the economy and the average American taxpayer would be enormous. As Trump’s reelection campaign responded, “Joe Biden is doubling down again on his ‘plan’ to hike taxes and massively increase the size of government. Biden has drastically underreported the true costs of his plans.… Instead of pro-job and pro-growth policies, Biden is turning to an old friend: tax hikes and big government.”

None of this likely to survive November 3, as evidence is increasing that the closer the voter looks at Biden and his plans to increase taxes and spending, the more they are viewing Trump as a vastly superior choice.

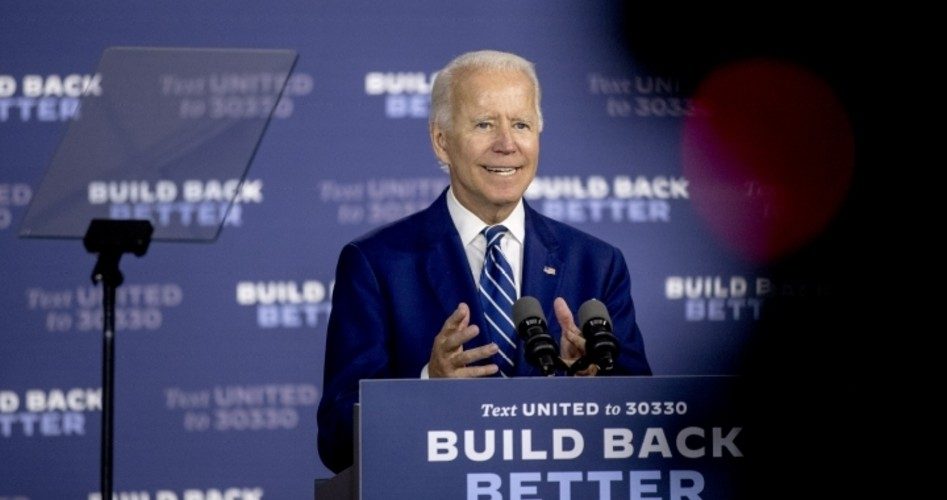

Photo: AP Images

An Ivy League graduate and former investment advisor, Bob is a regular contributor to The New American, writing primarily on economics and politics. He can be reached at [email protected].

Related article:

GOP Pollster Claims Media Polls Are Deliberately Skewed Against Trump