Resurrecting his “You didn’t build that; somebody else made that happen” theme, Barack Obama called for higher taxes on people whom he characterized as “society’s lottery winners.”

The comments were made Tuesday at a poverty summit at Georgetown University in Washington, D.C., where, alluding to his longstanding proposal to raise taxes on “carried interest,” Obama said, “If we were able to close that loophole, I can now invest in early childhood education that will make a difference. That’s…where the question of compassion and ‘I’m my brother’s keeper’ comes into play. And if we can’t ask from society’s lottery winners to just make that modest investment, then, really, this conversation is for show.”

Using the “isolate … personalize … polarize” Alinsky tactic he has relied on ever since winning society’s lottery and attaining the presidency, Obama singled out one specific group for scorn. After claiming that “where a previous CEO of a company might have made 50 times the average wage of the worker, they might now make a thousand times or two thousand times,” he lamented that “The top 25 hedge fund managers made more than all the kindergarten teachers in the country.” And according to a Washington Post analysis, this statement is accurate. Yet what’s implied may not be.

That analysis indicated that the top-25 hedge-fund managers earn on average $464 million each, and, Obama claimed, they’re “paying a lower rate than a lot of folks who are making $300,000 a year.” One solution to this is lowering the rate “folks who are making $300,000 a year” pay, but that doesn’t seem to be on Obama’s radar. This brings us to the first problem: The “top 25” might be good poster boys for tax increases, but no such increase is top-25 specific.

They tend to fall on people such as those earning $300,000 a year.

In fact, that very income places you in the top one percent — that demonized minority — in certain states.

Leftists will say that the one percent and other wealthy people don’t pay their fair share of taxes, but the facts say otherwise. Those earning 300G a year aren’t in the one percent nationally (they’re in the 95-99 percentile), yet they still pay 18.3 percent of total federal income tax despite drawing only 12.1 percent of total U.S. income (all figures from 2014). And the dreaded national one percent?

These three million people do command handsome incomes — above $615,000 — and take in 17.1 percent of all income.

They also pay 45.7 percent of all taxes.

How much more heavily should they be taxed?

The top 20 percent earn more than $134,300 (51.3 percent of income), but pay a whopping 83.9 percent of all income tax. And the rest?

The bottom 20 percent, those earning 0 to $24,200, only take in 4.5 percent of all income, but are responsible for -2.2 percent of all income tax. That’s not a typo; they pay negative tax because their tax credits are great enough so that not only do they owe no income tax, they actually receive money from the government. In fact, 43 percent of Americans pay no federal income tax.

Moving on, one might also ask: Why single out hedge-fund managers? The “top 25” in any field are quite an elite group and will obviously be exceptional in many ways. It’s said that boxer Floyd Mayweather set a record in getting $200 million for his last fight, against Manny Paquiao, and one analysis indicated that the two of them split $138,000 per second of their 36-minute bout. So why not bemoan the earnings of the top-25 athletes, actors, or pop stars (or politicians)? Economics professor Dr. Walter Williams provided the answer last year:

The strategy for want-to-be tyrants is to demonize people whose power they want to usurp. That’s the typical way tyrants gain power…. Fear and hate is an effective strategy for leftist politicians and their followers to control and micromanage businesses. It’s not about the amount of money top executives earn. If it were, politicians and leftists would be promoting jealousy, fear and hatred toward multi-multimillionaire Hollywood actors, celebrities and sports stars. But there is no way that politicians could usurp the roles of Drew Brees, Kobe Bryant, Robert Downey Jr. and Oprah Winfrey. That means celebrities can make any amount of money they want and it matters not one iota politically.

This is true even if, as Obama also said Tuesday about hedge-fund managers, “You pretty much have more than you’ll ever be able to use and your family will ever be able to use,” with the implication that they’re hoarding money unjustly. (Of course, the Obamas, Clintons, and Pelosis also have more-than-you-can-use money.) But this really depends on your definition of the word “use.”

Perhaps Obama got his economics education from the horror film The People Under the Stairs, in which a character — seeing a Fort Knox-like room of gold in an evil white couple’s basement — exclaims “No wonder there’s no money in the ghetto!” But the reality is that rich people don’t keep money under their mattresses. They may, however, invest in the stock market, which provides corporations working capital they can use to create jobs. Or excess cash could end up in banks, which aren’t just money warehouses; they provide loans to individuals and businesses, the latter of which also are used to create jobs — for people who are not rich.

As for Economics 101, here’s something to ponder. In biblical times, a man might be rich if he had 50 goats; there was precious little wealth to be had. Today, though, we enjoy modern opulence precisely because so much more wealth abounds. Whence did it come? Did God suddenly decide to lavish luxuries upon us?

Since the Law of Conservation of Mass and Energy tells us that “matter can neither be created nor destroyed” (at least by man), I won’t say wealth is “created.” But all this additional wealth obviously was “developed”; examples of how this happens are growing crops and using natural resources (e.g., timber, plants, minerals) to produce things that improve our lives. Thus, the goal of any economic policy should be to encourage wealth development — to become a wealthy civilization.

You don’t do this by punishing people for becoming too wealthy.

This brings us to the matter of wealth seizure, legalized theft, and an entity that truly never has enough money. As Dr. Williams wrote in 2012, “If Congress imposed a 100 percent tax, taking all earnings above $250,000 per year,” seized all the “profits of the Fortune 500 richest companies,” and all the assets of America’s 400 billionaires, it would keep the government running …

For about 360 days.

Yet despite a federal budget of almost $4 trillion, Obama still wants more. So one has to wonder, when he mentioned his obligation to be “my brother’s keeper,” did he mean keeper of other people’s money?

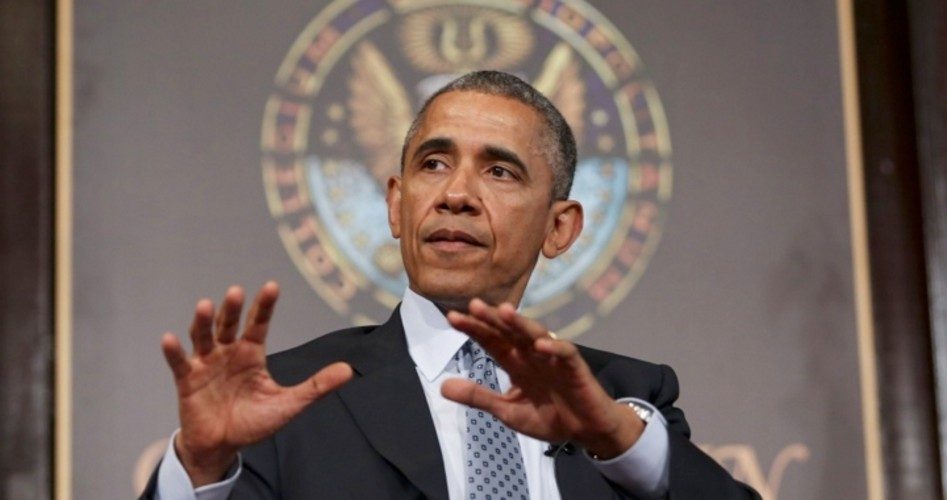

Photo at top: AP Images