The chief executive officer of health-insurance giant Aetna Inc. has publicly declared ObamaCare to be in a “death spiral” and said he expects a significant exodus of insurers from the Affordable Care Act (ACA) exchanges next year.

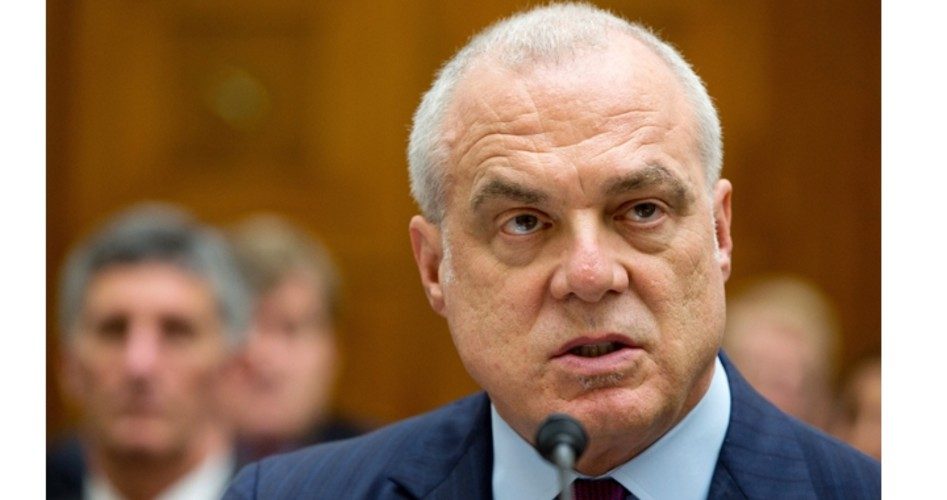

Speaking at the Wall Street Journal’s Future of Healthcare event Wednesday, Aetna CEO Mark Bertolini (shown) said, “There isn’t enough money in the ACA today as it is structured, even with its fees and taxes, to support the population that needs to be served.” That population consists of the sickest Americans, those with costly chronic conditions. “Our top one percent to five percent of our members … are driving 50 percent of our overall cost structure,” Bertolini claimed.

Since, under ObamaCare, Aetna is forced to cover those individuals at below-market rates, it needs a large pool of healthy plan members to offset the cost. “You know that mathematics education in the United States is working,” said Bertolini, when people can figure out that it’s in their best interest to forgo health insurance, even with the ACA’s individual-mandate penalty and subsidies, because their premiums and deductibles are so high as to make insurance a decidedly losing proposition. The average deductible for individual insurance nationwide is currently $3,600, an increase of 15 percent from last year, he said.

What happens when healthy people, who have low claims costs, decide to do without insurance? “The risk inside the pool keeps getting worse, the rates continue to chase it, and then the participants” — both healthy people and insurers — “start to leave,” Bertolini explained. Thus, he concluded, ObamaCare “is in a death spiral.”

ACA critics have long predicted precisely this outcome, and recent events have borne out their forecasts. The day before Bertolini made his remarks, Humana announced that it would be leaving the individual-insurance market, including the exchanges, in 2018, citing expected losses of $45 million in that market this year; the company had already scaled back its coverage to just 11 states for 2017. UnitedHealth Group abandoned all but three states this year. Even “Molina Healthcare, one of the few insurers that has done well in Obamacare, said Wednesday that it may also downsize” its exchange participation next year, reported CNN.

Aetna itself reduced its exchange footprint from 14 states to three this year because of a $450 million loss in those markets — red ink that Bertolini said would have reached $800 million to $900 million in 2017 had the company not dropped those states.

The exchanges, therefore, are already in bad shape and getting worse. Although they were supposed to be models of market competition, 70 percent of the counties in the nation have just one or two carriers on the exchange, according to CNN. That percentage is certain to increase with the departure of Humana: The Tennessean reported that the company’s move will leave the Volunteer State’s three major metropolitan areas with either zero or one insurer on their exchanges.

Bertolini said he expects that next year “we’ll see a lot of markets without any coverage at all.” He would not, however, say whether Aetna planned to exit the exchanges, explaining that the company still needed to “do more homework” to make such a determination but would do so by April.

Just after Bertolini made his comments, the Trump administration released a proposed rule that it hopes will entice insurers to remain in the exchanges while Republicans hash out their ObamaCare repeal-and-replace legislation. Among other things, the rule would significantly restrict the ability of individuals to enroll in coverage outside the annual enrollment period, which also would be pared down. Insurance companies have complained that people took advantage of the Obama administration’s lax enrollment rules to buy insurance only when they needed it and then drop it afterward, leaving insurers stuck with high claims and few premiums with which to cover them.

Whether the rule, if it is enacted, will really keep insurers from bolting the exchanges remains to be seen. “It’s not clear to me that that rule does enough to change health plan decision-making about whether to stay in the market,” Caroline Pearson, a senior vice president with consulting firm Avalere Health, told Politico. “I don’t know that it’s going to keep insurers in if they were otherwise inclined to exit.”

As to Republicans’ plans for ObamaCare, Bertolini said, “The repeal is easy. They can do that tomorrow if they want to. The question is what does the replacement look like and how long does it take to get there.” According to Politico, the Aetna chief “embraced a couple of ideas that are part of many GOP blueprints for replacing Obamacare,” including “catastrophic-coverage plans linked to health savings accounts in order to entice more young, healthy customers into the marketplaces.” But “he also called for a pool of money to subsidize insurers who attract particularly sick, expensive customers,” something that ObamaCare included for its first three years; such a provision seems unlikely to garner significant Republican support.

Bertolini’s remarks will surely give both congressional Republicans and President Donald Trump further ammunition for their battle to overturn ObamaCare. Unfortunately, as the conservative corporate-watchdog site 2ndVote points out, “Aetna is also funding the organizations lobbying to keep the entire system in place,” including the Human Rights Campaign, Planned Parenthood, Susan G. Komen, and the U.S. Hispanic Chamber of Commerce. “Perhaps,” observes 2ndVote, “Bertolini could help his company mitigate [its ObamaCare] losses by ceasing to fund the advocacy organizations that are fighting to keep these financially disastrous policies in place.”

Photo of Aetna CEO Mark Bertolini: AP Images