1) The IMF should be given huge new infusions of capital through member country “subscriptions.”

2) The IMF should be encouraged to issue debt bonds to finance global loans.

3) The IMF should be “legitimized” by giving China and other emerging nations weighted votes in IMF policies.

4) The IMF should be given vast new global financial regulatory powers.

What they are proposing is economic central planning on a global scale, a sort of international Federal Reserve, which would be a major step toward world central government. These new global powers are necessary, say the advocates, because the economic crisis we face is global. The glaring questions they don’t answer is where will we find: a) brilliant beings with god-like wisdom who can do the impossible and choose the right policies that will foster global prosperity; and b) incorruptible beings with angelic virtue who will not abuse the awesome powers to enrich and empower themselves?

Our current economic crisis can be laid at the feet of the Federal Reserve and the coterie of central bankers and commercial financiers who designed, promoted, and oversaw the destructive debt economy of the past two decades. For years, former Fed Chairman Alan Greenspan, “the Maestro,” was lionized and celebrated as the architect of global prosperity. Now that the house of cards he and his fellow central bankers constructed has collapsed, he publicly admits that he was not so brilliant after all. He claims he did not foresee the mortgage collapse and was mystified by fraudulent derivative products like CDOs (Collateralized Debt Obligations).

If Greenspan and associates were so colossally ignorant regarding the dangers of practices they were promoting, should we really be granting them even greater powers for economic malpractice on a global scale? An even darker (and seemingly forbidden) consideration is this: what if the policies that brought about the current economic crisis were not the result of ignorance? What if they were planned specifically to bring about the predictable (and predicted) crisis that we now find ourselves in, with a pre-planned follow-up “solution” that would entail vast new powers for the same individuals and institutions that had created the crisis in the first place? If that is the case, then we are not dealing merely with culpable ignorance, which is bad enough in itself, but with massive corruption and criminal conspiracy — or all of the above: culpable ignorance, massive corruption, and criminal conspiracy.

At any rate, concentrating global economic power in a few hands, as the IMF “supersizers” propose, is the very definition of tyranny. For, despite empty promises and boilerplate blather about “transparency” and “accountability,” the proposals provide no genuine checks and balances. The IMF as Global Fed would be about as accountable as our Federal Reserve, which refuses to divulge to Congress and the American people where trillions of dollars in Fed loans have gone.

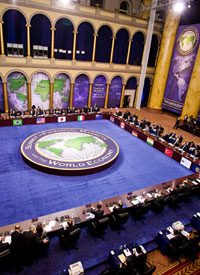

Here are some of the major promotionals for “supersizing” the IMF. Most of these are aimed at an elite audience of opinion molders and policymakers so that an international chorus of movers and shakers will have the momentum of “world opinion” flowing in the globalist direction by the time the G20 Summit rolls around in April.

• On January 28, Edwin M. Truman of the Peterson Institute for International Economics, writes an op-ed for VoxEU (and carried elsewhere) entitled, “IMF Reform: An Unfinished Agenda.”

• Australian Prime Minister Kevin Rudd was given prime op-ed space in the Wall Street Journal on February 11, for a piece entitled, “Renewing the IMF.”

• Lord Peter B. Mandelson, formerly the European Union’s trade commissioner and now the U.K.’s secretary of state for business, enterprise and regulatory reform, addressed the Council on Foreign Relations (CFR) on February 17 (“A Conversation with Peter B. Mandelson”) on the global economic crisis.

• On March 4, British Prime Minister Gordon Brown called for a "global New Deal" in a speech before a joint meeting of the U.S. Congress and in remarks the day before at the White House.

• On March 6, the Wall Street Journal reports on a new IMF proposal for a "binding code of conduct across nations" (“IMF Urges Global Financial Rules”).

• In a February 26 column, entitled “ A Message for the G20,” Martin Wolf, financial editor of the Financial Times issued another in his series of editorials in favor of supersizing the IMF. Wolf wrote the column to propose what he thinks President Obama should tell the G20 summiteers. According to Wolf:

The world now needs change it can believe in. Only Barack Obama, the US president, can provide the desired leadership: he is untainted, popular and leader of the country that, for good and ill, remains central. The opportunity for Mr. Obama is now, as the G20 ‘sherpas’ prepare the draft text. He needs to write urgently to his fellow heads of government. Something like this would be perfect.

“My fellow leaders, Franklin Delano Roosevelt abandoned his London summit. I wish to make ours the moment at which we save ourselves. Let us resolve to bequeath renewed prosperity to posterity, not a collapse of the global economy we inherited….

“So what must we now do?…

“Fifth, to get through this crisis and improve the functioning of the entire global system we need much larger, more effective and more legitimate international insurance and monitoring systems. The starting point has to be with a big increase in the resources of the International Monetary Fund and restructuring of voting rights in the institution….

“As Morris Goldstein of the Washington-based Peterson Institute for International Finance argues, we need a “grand bargain” — a phrase picked up by Gordon Brown, the UK’s prime minister. The core of that bargain is surely clear to us all. “Finally, we must put in train comprehensive reform of the structure not just of regulation, but of global finance itself. We need to push this process forward in London.…"

The Financial Times’ Martin Wolf is one of the most influential economic mandarins on the planet. A regular attendee of the secretive Bilderberg gatherings, he is viewed in knowledgable circles as a principal mouthpiece of the international banking establishment. Along with his Financial Times colleague Gideon Rachman, he is a (sometimes) out-of-the-closet world-government advocate. World-famous British author Frederick Forsyth relates that he once attended an exclusive closed meeting at the Financial Times at which the former Bundesbank president stated, “You will have to abandon the British nation state because the future has no provision for the nation state within it.”

The Financial Times never breathed a word of this meeting or the words of the German central banker to its readers. Like the New York Times, The Economist, the Wall Street Journal, and most of the “mainstream media,” the Financial Times is a very important part of what Forsyth referred to as “a very powerful cabal in our country that is quite literally dedicated, fanatically, to a futuristic dream. It’s a vision, it’s a dream, it’s an imagined utopia.” That “utopian” dream would become a dystopian nightmare for nearly everyone on this planet, if the plans to supersize the IMF are allowed to succeed.

Photo: AP Images

Related articles:

Agenda Behind Brown’s "Global New Deal"

Greenspan Wrongly Faults Free Market for Crisis

Economic Bubbles (by Ron Paul)