Jane Wells, a business news reporter for CNBC, after reviewing the latest report from the Congressional Budget Office (CBO) on who pays income taxes in America, claimed that the rich pay them all. The CBO, wrote Wells, showed that the top 20 percent pay nearly 93 percent of all income taxes, while the top 40 percent pay 106 percent of them.

How is that possible? The bottom fifth of wage earners get more from the government than they pay in taxes. Hence, the anomaly of the so-called rich paying more than 100 percent of all income taxes received by the government.

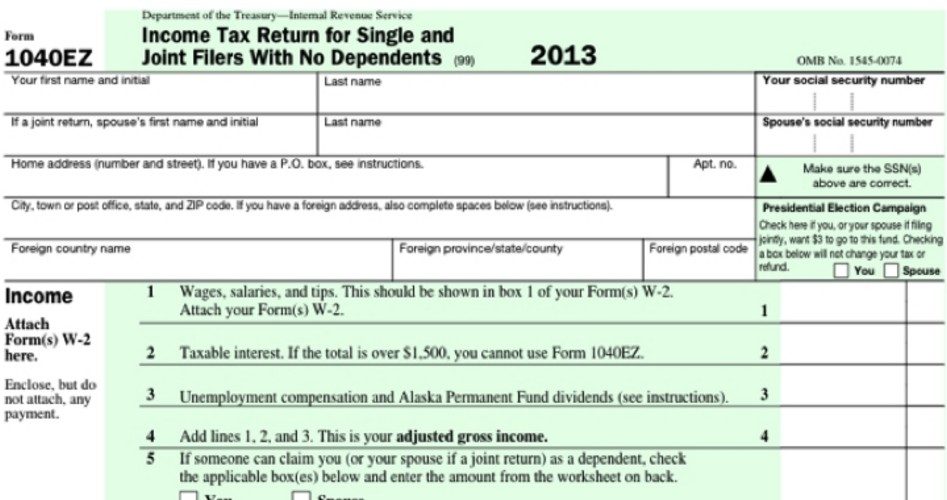

The CBO’s math is straightforward: For the year 2010, the bottom fifth earned “market income” — wages, business income, capital gains, retirement income, and so on — of $8,100 per person. But they also received “government transfers” — cash payments and in-kind benefits such as SNAP — of $22,700, leaving them with a per-person after-tax income of $30,800. Each person’s income tax liability in that group? Exactly zero.

For the second lowest quintile, the numbers for 2010 were similar: income of $30,700 per person, government transfers of $15,200 with income taxes paid of $2,500 per person, leaving them with an after-tax income of $43,400.

This government largess must be paid for in some way, and it’s the remaining three-fifths of Americans who do the paying, especially the top fifth. Says the CBO, the average wage earner in the top 20 percent of all wage earners had an income in 2010 of $234,000, received government benefits of $6,500 and paid taxes of $58,900, leaving each with an after-tax income of $181,900.

Concluded Wells:

People who make more should pay more, generally speaking. In America, they are.…

When it comes to individual income taxes, they’re also covering the entire bill. And leaving a tip….

Fair or not, I will let you be the judge.

Josh Barro, the politics editor at Business Insider, picked a nit with her but not about whether such taxation is “fair” but over her — and the CBO’s — analysis and conclusion: There are many other taxes aside from income taxes that every sentient soul in the country pays, whether they know it or not. There are payroll taxes, state income taxes, sales taxes, property taxes, and excise taxes. There are taxes buried in the cost of gasoline, and in manufactured goods reflecting corporate income taxes. There are employer-paid payroll taxes that properly should be ascribed to the individual wage earner. And so on.

Said Barro, “The federal personal income tax only made up 28% of all U.S. government tax collections in 2012. Federal, state and local government collected $4 trillion in taxes last year, just $1.1 trillion of that [coming from] federal personal income taxes.” He concluded:

Rich people do pay a lot more taxes than poor people, both in absolute terms and as a percentage of [their] income. But the rich are not paying all the taxes.

Barro neatly avoids any discussion, however, of just how “fair” these taxes are, or should be.

There are many ways to argue for or against the amount people pay in taxes. One way is to assume that government should take everything it can get — to be put to good use by the government — as long as the taxes by the government aren’t so high that they discourage people from earning money or paying taxes. If one were determined to extract the maximum government revenue from an economic system, he could employ the Laffer Curve, which shows that the maximum revenue to be extracted approaches some 70 percent of income. If it were higher than that, the incentive to produce more would diminish and revenues would go down. If it were lower, the government would be leaving revenues on the table for its original owners to spend as they wished.

Then there is the “sovereign citizen” argument that says that any extraction above zero represents “involuntary servitude” as explained by libertarian philosopher and economist Murray Rothbard:

In a sense, the entire system of taxation is a form of involuntary servitude. Take, in particular, the income tax. The high levels of income tax mean that all of us work a large part of the year — several months — for nothing for Uncle Sam before being allowed to enjoy our incomes on the market.

Part of the essence of slavery, after all, is forced work for someone at little or no pay. But the income tax means that we sweat and earn income, only to see the government extract a large chunk of it by coercion for its own purposes. What is this but forced labor at no pay?

There is the moral argument that the income tax system violates at least two of the 10 Commandments — thou shalt to steal and thou shall not covet — and three of the Seven Deadly Sins — Greed, Sloth, and Envy.

There is another response to the unanswered question, however, drawn from Article I Section 8 of the U.S. Constitution — the enumerated powers given to the national government. Prior to the ratification of the 16th Amendment, the national government ran itself on tariffs and excise taxes, at a vastly lower cost. One thing is certain, according to Ron Paul:

The Founding Fathers never intended a nation where citizens would pay nearly half of everything they earn to the government.

Nor did the Founders contemplate such a system of taxation. As Dr. Adrian Rogers, pastor emeritus of Bellevue Baptist Church, wrote,

What one person receives without working for[,] another person must work for without receiving. The government cannot give to anybody anything that the government does not first take from somebody else.

When half of the people get the idea that they do not have to work because the other half is going to take care of them and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that, my dear friend, is the beginning of the end of any nation.

A graduate of Cornell University and a former investment advisor, Bob is a regular contributor to The New American magazine and blogs frequently at www.LightFromTheRight.com, primarily on economics and politics. He can be reached at [email protected].