Over milkshakes and root beer floats at a Wally’s Burger Express in Austin, U.S. Sen. John Cornyn held a roundtable discussion on tax reform with three local small business owners several weeks after the Republican tax overhaul bill was passed by Congress.

The businessmen at the meeting were Bob Mayfield, the owner of Austin’s Dairy Queen and Wally’s Burger Express, Josh Agrelius, owner of Re-Bath of Austin, and ABC Home and Commercial Services owner Bobby Jenkins.

“We’re grateful that finally there is somebody looking out for our interests,” said Mayfield at the meeting.

Cornyn “wanted to know how the tax reform measure was going to affect our businesses,” explained Mayfield. He replied at the meeting that his business was going to expand by two restaurants because of the Tax Cuts and Jobs Act, adding that he was also thankful that the act doubled the estate tax exemption.

“There is not one small business in the country that is not worried about death taxes,” said Mayfield. “You work your entire life and build a business or buy real estate so you don’t have a lot of cash on hand to pay death taxes when you die. What I am so grateful for is the doubled exemption. It’ll make it so much easier to pass your business on to your children.”

The new law changes the federal estate tax, doubling the amount of the “exclusion amount.” Under prior law, the exemption amount in 2018 would have been $5.6 million per person but it will now be $11.2 million per person. The larger tax exemption amount will serve to make the estate tax a non-issue in more business ownership transfers.

In her December 17, 2017 commentary in the Washington Examiner, “Tax bill would help ordinary Americans and small business owners like me,” Mary Schiavoni expressed approval of the tax reforms.

The new tax bill will “take money from the middle class and give it to the wealthiest people in the world,” declared The New York Times editorial board.

“As a small business owner, all I can say is, what tax reform bill are they looking at?,” asked Schiavoni in her article. “I can personally attest to the significant relief it will offer to small business owners and ordinary American workers like myself.”

Explained Schiavoni, “as a pediatric speech pathologist, I developed a series of treatment tools for children and adults, known as ‘Chewy Tubes.’ And my line of developmental baby teethers, made in the USA, helps parents around the globe to get little mouths off to a healthy start. I started my company on my back porch. The pending tax reform bill could take it to Main Street.”

In addition to her entrepreneurial spirit, Schiavoni is adept at linking the economics and incentives in the tax bill to resultant increases in investment, incomes, and hiring.

“Curiously enough, one headline provision included in the bill has barely been reported on,” she wrote. “This bill creates a new 20 percent small business deduction. In other words, for a business with $200,000 a year in annual earnings, $40,000 would be completely tax free. This provision helps smaller businesses to better compete against big business and international competitors, who currently face lower tax burdens than most small businesses. I currently employ five people. This tax cut would allow me to provide bonuses for current employees, hire more employees, expand my workspace, and purchase inventory.”

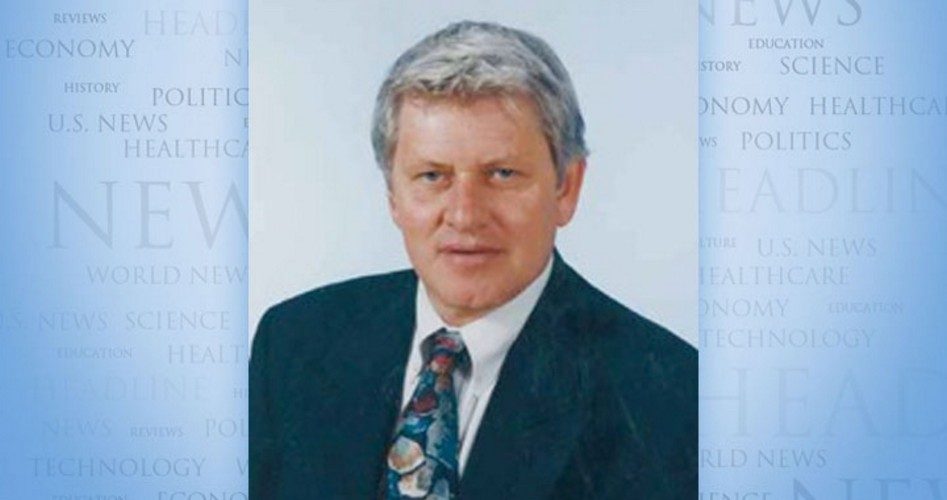

Ralph R. Reiland is Associate Professor of Economics Emeritus at Robert Morris in Pittsburgh. His email: [email protected].