On Friday Reuters reported that non-government payrolls rose only slightly in June and overall employment fell “for the first time this year … indicating the economic recovery is failing to pick up steam.” This report followed several others last week indicating weakness in consumer spending, housing, and manufacturing which “have heightened fears [that] the economy could slip back into a recession.”

Even with housing prices continuing to slide, “Current prices are still way too high because the [current] decline [hasn’t yet reached] the ‘fair value’ level compared to rent and income levels,” according to Barry Ritholtz, founder of Fusion IQ, an investment research firm. He went on to estimate that housing prices could fall another 10 percent.

A careful analysis of the Department of Labor’s announcement on July 5 here showed, to no one’s surprise, that the numbers had been fudged. About the only good news was, according to Reuters, “A poor labor market in an election year is the worst nightmare for Obama and could cost the Democratic Party dearly in [the] November mid-term elections.”

Pew Research said that the labor market, as bad as it appears to be, number-fudging or not, is vastly worse than reported: “About a third of adults in the labor force have been unemployed for a period of time during the recession. And … 55 percent in the labor force say that during the recession they have suffered a spell of unemployment, a cut in pay, a reduction in hours or an involuntary spell in a part-time job.” And most Americans polled in the survey say the U.S. economy is still in a recession.

The issue of a double-dip recession was reported here with expectations that additional data on the economy to be announced shortly would confirm the double-dip. As noted, the Economic Cycle Research Index (ECRI) had gone negative, causing Hussman Funds manager John Hussman great concern that continued slippage would “complete the recession warning.” In his latest report, he warned: “What prompts my immediate concern is that the … ECRI Weekly Leading Index has now declined to -6.9 percent … [confirming] evidence that has always and only [his emphasis] been observed during or immediately prior to U.S. recessions.” In a remarkable moment of candor, Hussman said:

In recent months, I have finessed this issue by encouraging investors to carefully examine their risk exposures. I’m not sure that finesse is helpful any longer. The probabilities are becoming too high to use gentle wording. Though I usually confine my views to statements about probability and "average" behavior, this becomes fruitless when every outcome associated with the data is negative, with no counterexamples [emphasis added]. Put bluntly, I believe that the economy is again turning lower, and that there is a reasonable likelihood that the U.S. stock market will ultimately violate its March 2009 lows before the current adjustment cycle is complete. At present, the best argument against this outcome is that it is unthinkable. Unfortunately, once policy makers have squandered public confidence, the market does not care whether the outcomes it produces are unthinkable. Unthinkability is not evidence.

Putting that into layman’s language, Hussman concluded: “Based on our standard valuation methods, the S&P 500 Index [which peaked at 1,576 on October 11, 2007, and is currently trading at 1,022] would have to drop to about 500 to match historical post-war [lows]….In short, my concerns about the economy and financial markets are escalating quickly. Given the already vulnerable condition of the U.S. economy, a second phase of weakness would most likely contribute to [higher] levels of mortgage delinquency and foreclosure, and could be expected to push the [official] unemployment rate towards 12 percent [from its current level of 9½ percent].”

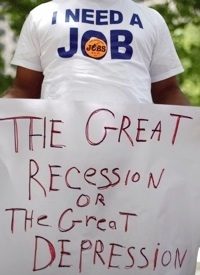

As the Great Recession continues, Hussman and others continue to issue warnings that, bad as things are, they could get much worse. The much-touted economic recovery remains invisible.