On the heels of last week’s report that interest on the $14.13 trillion national debt will quadruple in the next decade, we now learn how much means for the average American household.

Terence P. Jeffrey of CNSNews.com offers a quick snapshot of how much the debt per household has increased since President Obama signed his stimulus bill.

“The federal government has borrowed an additional $29,660 per household in the United States since President Barack Obama signed his economic stimulus law two years ago,” Jeffrey reported last week.

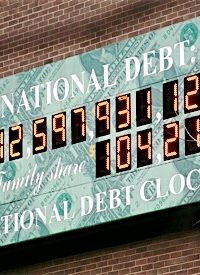

That brings the total national debt to $125,475.18 per household:

At the close of business on Feb. 17, 2009, the day Obama signed the $787-billion law, the national debt stood at $10.79 trillion ($10,789,783,760,341.41), according the Bureau of the Public Debt [2]. At the close of business on Feb. 16, 2011, the national debt stood at $14.13 trillion ($14,129,889,690,377.50) — an increase of $3.34 trillion (3,340,105,930,036.09).

The U.S. Census Bureau estimates that there are a total of 112,611,029 households [3] in the United States, which average about 2.6 people per household. That means that the new debt accumulated in the two years since Feb. 17, 2009, when President Obama signed his economic stimulus law, equals about $29,660.55 per household.

Those staggering numbers are no surprise. As The New American reported last week, citing the Washington Post, “within 10 years, interest payments on the $14 trillion-plus national debt will exceed all budgetary outlays for all spending except defense and Social Security.” The interest payment per American citizen will be $2,500 annually.

The U.S. Debt Clock shows that each American citizen owes $45,577 on the national debt. But not all citizens are taxpayers. Each taxpayer owes $127,792. And those figures don’t count personal debt, plus government debt or unfunded liabilities.

If all indebtedness, public and private, is counted, the indebtedness per person is $179,346. Each family owes $682,516.

Federal unfunded liabilities, which include Social Security, Medicare and prescription drugs, total $112.6 trillion, or more than $1 million per taxpayer.

Adding U.S. government debt to unfunded liabilities, which totals $126.7 trillion, then subtracting the nation’s $72.8 trillion in assets, leaves $54 trillion in unpaid federal debt.

Each American taxpayer is on the hook for $487,000.

Photo: This Feb. 1, 2010, file photo shows the National Debt Clock in New York.: AP Images