In her keynote speech last week to the annual global gathering of central bankers in Jackson Hole, Wyoming, International Monetary Fund Managing Director Christine Lagarde praised the “unconventional monetary policies” employed by the Federal Reserve and other central banks. She called central bankers “heroes of the global financial crisis,” urged them to boldly continue usurping new powers, and warned against slowing “quantitative easing,” the Fed’s program of funny money creation that has already pumped trillions of dollars into various bank bailouts and other schemes that it has refused to provide details on, either to Congress or the American people.

“In many respects,” Lagarde told her Jackson Hole confreres, “central banks have been the heroes of the global financial crisis. Compared with conventional monetary policy, the unconventional monetary policies of the past few years have been bolder in ambition and larger in scale. These exceptional actions helped the world pull back from the precipice of another Great Depression.”

The title of Lagarde’s speech was “The Global Calculus of Unconventional Monetary Policies.” Unconventional Monetary Policies, or UMP, is the catch-all euphemism invented by the Fed to paper over the broad range of new counterfeiting, swindling, theft, and other criminal activities it and its banking partners have been employing over the past several years to transfer trillions of dollars from savers and taxpayers to banking and corporate cronies and bankrupt governments.

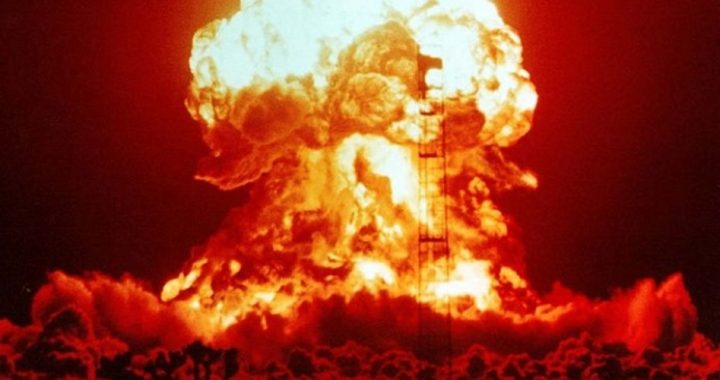

EMP or UMP — Which Is More Destructive?

The dangers of an EMP, or electromagnetic pulse, have been much discussed by scientists, military strategists, national security analysts, and preparedness advocates, often referred to as “preppers.” An EMP could be the result of either a severe solar storm (a coronal mass ejection) or an act of war, in which an enemy detonates a nuclear weapon above the United States, at an altitude of 25 miles to 100 miles, or more. A severe EMP could knock out the power grid and telecommunications, as well as fry the electrical systems in automobiles, computers, and many home and office electronic products. Obviously, an EMP, whether produced by the sun or an enemy WMD, would be a bad thing.

But what about the impact of UMP, which is not some “what if” theoretical threat some time in the future; UMP has already been wreaking global economic havoc for several years, though the full destructive consequences of UMP have been barely perceived. Stripped of its semantic camouflage, UMP would be more easily recognized as, and described as, Unlimited Money Proliferation or Unconstitutional Monetary Powers, since, under the guise of UMP, the Fed and other central banks have assumed unprecedented powers to create massive quantities of money out of thin air, which is counterfeiting, and which surreptitiously steals from all the people and institutions who hold dollars — whether the dollars are in their pockets, their bank accounts, pensions, 401Ks, or other investment vehicles. It is difficult to overstate the colossal destruction that UMP has already wrought — and it is still ongoing.

As The New American reported back in 2010, “The Special Inspector General for the Troubled Asset Relief Program (SIGTARP) estimated the potential total cost of the combined crisis bailouts at $23.7 trillion, or more than $75,000 per person in the United States.”

But that was before the Fed launched its even more ambitious UMP attacks. In September 2012, Fed Chairman Ben Bernanke announced that the Fed would begin buying $40 billion per month of mortgage backed securities, and then in December of last year announced that it would be adding another $45 billion per month in Treasury bond purchases. It has been “buying” $85 billion worth of these toxic securities every month — over a trillion dollars worth so far — with barely a peep of protest from Congress or media analysts. Many of those who have questioned or protested the Fed’s UMP have merely questioned the amount of the purchases or the mix of securities, or the timing; few have actually challenged the Fed’s usurpation of power or the immorality and criminality involved in the Fed’s rewarding of the perpetrators of our current economic woes by transferring trillions of dollars to favored banks, most of which have been leaders in the financial fraud and malpractice that brought on the global crisis.

According to Madame Lagarde, “Above all, we must use the time wisely and not waste the space provided by unconventional policies. Global policymakers — all policymakers, within countries and across countries — have a responsibility to take the full range of actions needed to restore stability and growth, and to reduce imbalances.”

Those conversant in IMF globospeak will recognize this, along with Lagarde’s additional comments, as a clear call for central bankers to push forward boldly and rapidly with new innovations that provide the global banking cartel — “the money power” — with unlimited options for financial deviltry … all in the name of “stability and growth.”

But all the self-congratulations and media apologetics aside, what kind of growth and stability have the mammoth and unprecedented UMP efforts produced? Euro Pacific Capital’s Peter Schiff wrote this insightful analysis in April of this year:

After selling off an astounding 56% between October of 2007 and March 2009, the S&P 500 has staged a rally for the ages, surging 120% and recovering all of its lost ground too. This stunning turnaround certainly qualifies as one of the more memorable, and unusual, stock market rallies in history. The problem is that the rally has been underwritten by the Federal Reserve’s unconventional monetary policies. But for some reason, this belief has not weakened the celebration.

“Although the Fed has been tinkering with interest rates and liquidity for a century,” Schiff noted, “nothing in its history could prepare the markets for its activities over the last four years.” Schiff continued:

And while most market analysts give credit to Ben Bernanke for saving the economy and sparking the rally, they have not fully grasped that market performance is now almost completely correlated to Fed activism. A detailed look at stock market movements over the past four years reveals a clear pattern: upward movements are directly tied to the delivery of fresh stimulants from the Fed. Downward movements occur when markets perceive that the deliveries will stop. In other words, the rally is really just a bender. The rest is commentary.

Since 2008, the Fed has injected fresh cash into the economy with four distinct shots of quantitative easing and has added two kickers of Operation Twist. In recent months, the Fed has dispensed with the pretense of designing, announcing, and serving new rounds of stimulus and is now continuously monetizing over $85 billion per month of Treasury and mortgage-backed debt. The new cash needs a place to go, and stocks, which now often provide higher yields than long term Treasury bonds, and which offer much better protections against inflation, provide the best outlet.

Schiff then provides graphs and statistics substantiating that the up-down stock market pattern of the past four years is directly tied to the drug-like injections of UMP stimulants into the addicted economy. (To read Peter Schiff’s full column, click here.)

But Lagarde and the banking cartel are not backing off; in fact, they intend to push forward with ever greater audacity. “Where do we stand with UMP today?” Lagarde asks, then answers:

Let me say it up front: I do not suggest a rush to exit. UMP is still needed in all places it is being used, albeit longer for some than for others. In Europe, for example, there is a good deal more mileage to be gained from UMP. In Japan too, exit is very likely some way off.

The day will come when this period of exceptionally loose monetary policy, both conventional and unconventional, must end — in line with economic recovery and its impact on inflation. We need to plan for that day, especially since we do not know exactly when it comes.

A little further on she states that the “exit from UMP is likely to be slower and longer than is often portrayed, and feared.”

The point is that whether Bernanke and company begin “tapering” the Fed’s $85 billion/month purchases later this year, or in 2014 (or whether they end up, in fact, increasing their purchases), it is all an arbitrary decision of monumental consequence made by human beings who view themselves as god-like Olympians, above and beyond the rule of law that constrains mere mortals, such as the rest of us.

Lagarde as Esther Williams

Apparently, Christine Lagarde imagines herself as Esther Williams, the 1940s-50s swimming sensation and MGM aqua-musical glamor queen, choreographing the global money manipulators in a grand synchronized swimming spectacular. “The world has done enough treading water,” she declared in her closing remarks. “It is time now for policymakers to swim to the shore. Take this as some wisdom from a former synchronized swimmer!”

This was not the only use of water and swimming metaphors in her speech. Earlier in her presentation, she said:

The challenge for today’s generation of policymakers is to rethink and reimagine how to get our economies back to work. One of the most striking aspects of that has been the willingness of central banks in advanced economies to “dive into the deep end” of the policymaking pool.

Again, in IMF globospeak, that translates into encouraging experimentation and usurpation of as much power as can be gotten away with. Expanding on her use of metaphors, Lagarde refers to the IMF and her fellow bankers as a light in the darkness. She told her fellow illuminati:

More broadly, unconventional monetary policies involve navigating a new world. In one sense, it is like stepping into a dark room. To borrow some words from John F. Kennedy: “We are not here to curse the darkness, but to light the candle that can guide us through that darkness to a safe and sane future.” It is our collective job to light a candle in that dark room.

But that light is meant for only the initiated, the insiders. That is why the Federal Reserve, the IMF, and their central bank partners in crime have resisted so vehemently every effort to audit their books and to truly shine a light on the operations they have worked, and continue to work, in murky darkness. Unless Congress can be forced to rein in this rampant criminality, the remaining vestiges of freedom we still enjoy will be swept away in a tidal wave of debt and digital currency. And, as famed investor Jim Rogers warned recently, these “heroes” — as IMF’s Lagarde calls them — are going to take everything they possibly can. “They’re going to take money wherever they can,” he said. “… They’re going to take our bank accounts and retirement accounts.”

Related articles:

Jackson Hole Conclave: Central Bankers Plan Global Theft, Massive Pain

World Bank Insider Blows Whistle on Corruption, Federal Reserve

Fed Manipulations in the Crosshairs

Now, More Than Ever, Time to Audit the Fed

Larry Summers to Replace Ben Bernanke at the Fed?

After Gold Crash, Experts Point to Central Bank Manipulation

Jamie Dimon, JP Morgan Chase & The Fed: Billions & Trillions for Insiders

Killing the Dollar: G20 & IMF Push for Global Fed, Global Currency

IMF as Global Fed: G20’s Agenda Behind the Agenda

International Monetary Fund (IMF) Leader Calls for Trillion-dollar “Firewall”

Federal Reserve Secretly Bails Out European Banks … Again

Bernanke Whitewashes Fed Responsibility for “Great Recession”

Bernanke Issues Warnings, Accepts No Blame

Taking Delight in Deception: Greenspan’s “Purposeful Obfuscation”

Fed Didn’t Recognize Housing Crisis in 2006, Transcripts Show