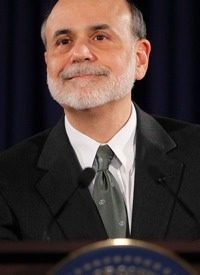

Three years after the Federal Reserve's massive and continuing interventions in the financial markets, Bernanke was forced to admit that “recent indicators point to continuing weakness in overall labor market conditions and the unemployment rate remains elevated … and consequently [the Fed] anticipates that the unemployment rate will decline only gradually…. Moreover, there are significant downside risks to the economic outlook.” He added that “we did underestimate the pace of recovery for some fundamental reasons,” including the continuing declines in the real estate markets and “a certain amount of bad luck.”

Bernanke was forced to reduce further his estimates about the rate of economic growth, now predicting that the U.S. economy will grow at only 1.6 percent to 1.7 percent in 2011, and that 2012 growth will range between 2.5 percent and 2.9 percent, nearly a full percentage point below his previous estimates. He also sees unemployment remaining sticky at between 8.5 percent and 8.7 percent, higher than the 7.8 percent predicted in June. What little growth he has seen in the last month amounts to nothing more than consumers' reaction to the decrease in gasoline prices and Japan’s recovery from the earthquake and tsunami last spring.

During the question-and-answer session, Bernanke was forced to defend the Fed’s actions that its actions are setting the stage for high price inflation for consumers. He rejected such charges, saying that inflation has remained relatively benign, around 2 percent, over the past few years, and that such criticism “has not proved valid.” Yet a look at the FRED charts here, here, and here indicate that the Fed has increased the M1 money supply by 20 percent just in the last year, and that the velocity of consumer spending has jumped significantly since July, which is being reflected in higher consumer price inflation approaching 4 percent rather than the 2 percent claimed by the Fed chairman.

He “sympathized” with the Occupy Wall Street (OWS) movement but said that their concerns "about the Fed are misplaced [and that] the Fed’s bailouts of banks were not intended to keep bankers rich but to protect the financial system.” Informed observers know that the Fed is a cartel designed from its infancy to protect the banks from their own follies and not to protect the consumer or his purchasing power.

When asked why the Fed wasn’t doing more in the face of its gloomy outlook, Bernanke responded that they are in fact being “very aggressive” and are now waiting “to see what happens” before implementing any other strategies. Bernanke claimed to have a “broad range of policies” available to stimulate the economy but refused to elaborate on just what they were.

In responding to continued demands for a complete audit of the Fed by Congress, Bernanke said, “Politics is politics, and the Federal Reserve tries to stay nonpartisan. Our job is to do the best we can for the U.S. economy, to do what we can to attain our mandate of maximum employment and price stability.”

Following Bernanke’s responses, Republican presidential candidate Ron Paul (R-Texas) was pleased that his criticisms of the Fed over the years are finally gaining traction. On MSNBC’s Morning Joe on November 3, Paul remarked:

The country has changed — dramatically different. I can compare to four years ago. Just think of the success with the Federal Reserve. Bernanke has to go out before the people at press conferences. They’re on the defensive now….

He added: "The movement is in our direction…. You talk about the failure of the Fed; this is significant. They don’t have any cards left to play."

A month earlier, on October 4, Paul gave a statement to his House Subcommittee on Domestic Monetary Policy and Technology wherein he warned against “the pretense of knowledge, the idea that policymakers have sufficient knowledge and power to shape society as they wish.” He said that "today's economic Mandarins seem hell-bent on destroying every last vestige of the free market and driving the economy into ruin,” and that "Congress has abdicated its oversight over these 'expert' economists at the Federal Reserve." Paul claims that even though the Fed is an instrument created by Congress, it remains free of any meaningful oversight:

Congressional oversight of the Fed amounts to about twelve hours of hearings per year, and that’s as far as it goes. Of those twelve hours, no more than five or ten minutes goes to any one Congressman, who has the opportunity to ask at most one question of Chairman Bernanke every six months….

The Federal Reserve is a creature of Congress and should be treated as such, not as an organization exempt from Congressional oversight…. [The Fed] tries to remain unaccountable both to Congress and to the American people. Pumping trillions of dollars into the economy with no oversight and accountability cannot be allowed to continue. Audit the Fed now.

As Bernanke’s failures to stimulate the economy and reduce unemployment become more and more obvious, the more difficult it will be for the chairman to defend successfully the Fed’s actions. As Paul’s success in directing voters’ attention to those failures increases, the day of full disclosure of the Fed may be just a matter of time.