The catastrophic news on the U.S. Government’s debt keeps coming. Since Jan. 5, when The New American reported that the debt had surpassed $14 trillion, the government has added more than $150 billion in unpaid bills.

Terence P. Jeffrey, of CNSNews.com, explains how fast the debt is growing with his latest summary of data from the federal government.

According to Jeffrey, who regularly looks at the budget with the scrupulous eye of a bank inspector, the government’s debt increased $63.7 billion in February. As well, he reports, the government drained more than $150 billion from its cash reserves:

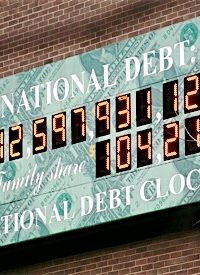

At the close of business on Jan. 31, the total federal debt stood at $14.131 trillion ($14,131,051,056,010.84), according to the Treasury Department’s Bureau of the Public Debt. At the close of business on Feb. 28, it stood at $14.195 trillion ($14,194,764,339,462.64), an increase of $63.713 billion ($63,713,283,451.80) in new debt that was accumulated during the shortest month of the year.

To save the government from having to borrow even more money in February, the Treasury significantly diminished the balance in its cash accounts, according to the department’s Daily Treasury Report released today. At the beginning of the month, Treasury’s cash balances equaled $349.1 billion. At the end of the month, they were down to $190.6 billion — a drop of $158.5 billion

Jeffrey reports that the federal debt increased $105.8 billion in January.

It won’t be long before the federal government runs up against its debt limit of $14.294 trillion. On Wednesday, President Obama signed a temporary spending bill that will keep the government running until March 18. Had Congress not come to an agreement, the government would have shut down on March 4.

Last week, Jeffrey reported what the choking level of federal debt means for the average American during the first two years of the Obama Administration: Nearly $30,000 of additional debt per household.

The Debt Cannot Be Paid Off

As The New American reported in January, the federal debt is now so large it cannot be paid off. The Economic Collapse website explains that “the U.S. government now owes more dollars than actually exist.”

If the U.S. government went out today and took every single penny from every single American bank, business and taxpayer, they still would not be able to pay off the national debt. And if they did that, obviously American society would stop functioning because nobody would have any money to buy or sell anything.

One reason the debt cannot be paid, the website explains, is fractional reserve banking, which allows banks to lend more money than they have on deposit. So although the economy contains about $14 trillion in assets, not all of the $14 trillion is real cash.

So much of the “money” out there today is basically made up out of thin air.…

So if the U.S. government went out today and demanded every single dollar from all banks, businesses and individuals in the United States it would not be able to collect.

Unfunded Liabilities

The national debt of $14 trillion, or $128,016 per taxpayer, does not include the unfunded liabilities of Social Security, Medicare, and the prescription drug program, which total $112.8 trillion. The liability for per taxpayer for that bill, according to the U.S. Debt Clock, is more than $1 million.

The federal deficit is $1.33 trillion and rising.