Data posted on the Treasury Department’s TreasuryDirect website on January 19, the day before President Barack Obama’s final day in office, showed a total public debt outstanding of $19,961,467,137,973.64. The corresponding figure for January 20, 2009, the day Obama took office, was $10,626,877,048,913.08. Therefore, the national debt under Obama grew by about $9 trillion, or an increase of 86 percent.

A report on the increase in Business Insider acknowledged that some of some of this debt (particularly in 2009) was attributable to bills passed by Obama’s predecessor, George W. Bush, but did not provide specific figures about how much of the debt originated with the Bush administration.

Another report from CNS News on January 19 noted that the increase in the national debt under Obama equals approximately $75,129 for every person in the United States who had a full-time job in December.

Citing data from the Bureau of Labor Statistics, the report stated that there were 124,248,000 people in the United States with full-time jobs in December. Therefore, the total federal debt of $19,961,467,137,973 equals approximately $160,658 for each of those workers.

The Daily Caller reported on January 19 that in addition to the large amount added to the national debt, the Obama administration implemented 3,069 regulations, adding an estimated $898.4 billion in costs to the economy. These regulations added nearly 572,000 pages to the Federal Register, including 97,110 pages in 2016 alone, which was an all-time record.

The Daily Caller reproduced a chart produced by the American Action Forum, which is run by former Congressional Budget Office director Doug Holtz-Eakin. That chart also illustrated that the Obama administration’s regulations were responsible for an increase of 558,660,470 paperwork hours for American businesses.

President Trump has pledged to undo many of Obama’s policies that were put in place by executive orders, noted the Daily Caller.

But the report noted that Trump’s ability to roll back Obama-era regulations and policies by means of executive order will be limited, since Congress will have to pass legislation to repeal many of them.

Just a few weeks ago, we posted an article about the increase in the national debt of more than one trillion dollars during 2016 alone. In that article, we observed:

In case anyone wants to place all of the blame for the debt increase on the Democrats, CNSNews noted that during 2016, while Democrat Barack Obama controlled the presidency, Republicans controlled both houses of Congress.

This is significant, since, according to the Constitution, all bills for raising revenue must originate in the House of Representatives (Article I, Section 7), and Congress shall have power to borrow money on the credit of the United States (Article I, Section 8).

Consequently, even the most profligate occupant of the Oval Office cannot spend a dime or borrow a dime unless Congress gives its approval.

In that article, we pointed out a fact that might surprise some fiscal conservatives who think that our federal government always spends more under Democratic presidents than it does under Republicans. Taking a look at the history of the national debt during the past 39 years, we find that our nation’s fiscal health — in terms of the size of the national debt — fared better under Democrats Carter and Clinton than under the ostensibly conservative Ronald Reagan and both presidents Bush, before escalating more rapidly under Democrat Obama.

In that article and another one posted last September, we discussed the potential effects of one of the economic solutions proposed by President Trump — a massive cut in the corporate income tax rate from 35 percent to just 15 percent. We recalled that during the John F. Kennedy administration, income tax rate cuts resuscitated a moribund economy, just as they did under Ronald Reagan.

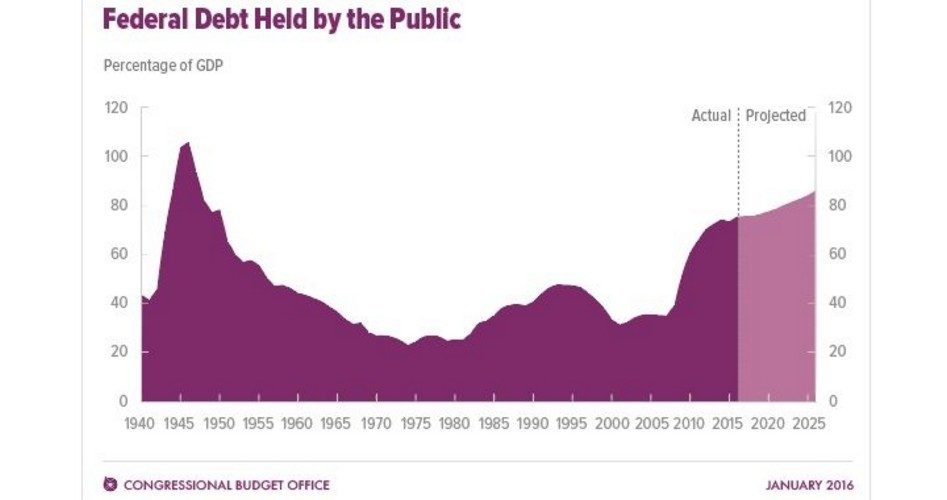

We also noted that when President Bill Clinton cut the capital gains tax from 28 percent to 20 percent in the highest bracket, and from 15 percent to 10 percent in the lowest: real (inflation-adjusted) Gross Domestic Product (GDP) per person grew from $38,000 in 1994 to $45,000 in 2001. At the same time, the country’s national debt fell as a percent of output by a full 10 percentage points, from 66 percent to 56 percent.

Comparing our nation’s economic experience under Clinton to how Trump’s plan might play out, we wrote:

If Clinton’s cut in the capital gains tax resulted in a 10-percent drop in the national debt, could Trump follow suit?

The key question is not so much if Trump can repeat Clinton’s success story, but if he will be willing and able to do so. This depends on two factors: One, he must follow though on his campaign promises and introduce the tax cuts, and two, members of Congress, including the Republican majority in both houses, must be cooperative and pass legislation putting these proposals into effect.

Related articles:

National Debt Increases by $1,054,647,941,626.91 in 2016

Obama’s Basket of Economic Deplorables

Candidates Silent as Government Spending Jumps, Deficit Increases