The Japanese telecommunications giant SoftBank Group, Corp. announced on December 19 that it had agreed to invest $1 billion in the satellite manufacturing operation built in Exploration Park, Florida, by OneWeb LLC. OneWeb plans to build and deploy a constellation of hundreds of satellites in low-Earth orbit over the next decade, which will provide Internet access to many unconnected areas of the world.

The new investment deal will give SoftBank and its partners nearly half ownership of OneWeb Satellites, a company based in Arlington, Virginia, that is a 50-50 joint venture between its parent, OneWeb LLC, and Airbus.

The investment is expected to create almost 3,000 new engineering, manufacturing, and support jobs in the United States over the next four years, OneWeb Satellites announced in a statement cited by the Japan Times.

When SoftBank’s CEO and founder, Masayoshi Son (shown), met with President-elect Donald Trump at Manhattan’s Trump Tower on December 6, he pledged to invest $50 billion in the United States and create jobs. A press release issued by SoftBank on December 19 announcing the $1 billion investment the firm was making in OneWeb, quoted the following statement from Son:

SoftBank has a long history of investing in disruptive, foundational technologies that promise to help us realize the future sooner. OneWeb is a tremendously exciting company poised to transform Internet access around the world from their manufacturing facility in Florida.

Earlier this month I met with President-Elect Trump and shared my commitment to investing and creating jobs in the U.S. This is the first step in that commitment. America has always been at the forefront of innovation and technological development and we are thrilled to be playing a part in continuing to drive that growth as we work to create a truly globally connected ecosystem.

The New York Times reported that while at the Trump Tower meeting earlier this month, Son estimated that his company’s $50-billion investment in the United States would create about 50,000 jobs. Trump has cited the pledge as a sign that he is capable of persuading the private sector to play a leading role in making improvements to the national economy.

The firm’s December 19 press release also quoted OneWeb founder Greg Wyler, who said:

I have long admired Mr. Son’s track record and his vision for the future of a technologically-powered world. I am honored to welcome SoftBank as a long-term investor and strategic partner. SoftBank’s investment underscores the evolution and continued success of our company and accelerates our strategic growth plan. We look forward to working together as we execute on our mission to build a global knowledge infrastructure that provides affordable broadband to the over four billion people across the globe without internet access

Wyler said that many of the jobs would be at OneWeb’s satellite manufacturing plant in Florida.

This news of projected job growth launched by the private sector is one of several such encouraging economic events reported recently. An article posted by The New American on December 8 quoted a statement from U.S. Steel’s CEO Mario Longhi that he’d like to bring back to the United States up to 10,000 jobs. The article pointed out that U.S. Steel used to employ 37,000 people, but that figure dropped to just 21,000 as of last December, due not only to the Great Recession and its feeble recovery, but also to excessive regulations. Longhi said:

There was a point in time in the past couple of years that I was having to hire more lawyers to try to interpret these new regulations than I was hiring engineers. That doesn’t make any sense.

The article noted that investors in the company’s common stock interpreted the election of Trump to the White House as a sign that the regulatory burden hampering the profitability of companies such as U.S. Steel might soon be abated. Since the election, U.S. Steel’s common stock has jumped 80 percent.

The article also commented on what happened following the pledge by SoftBank founder Son to invest $50 billion in the United States, which he said would create 50,000 jobs:

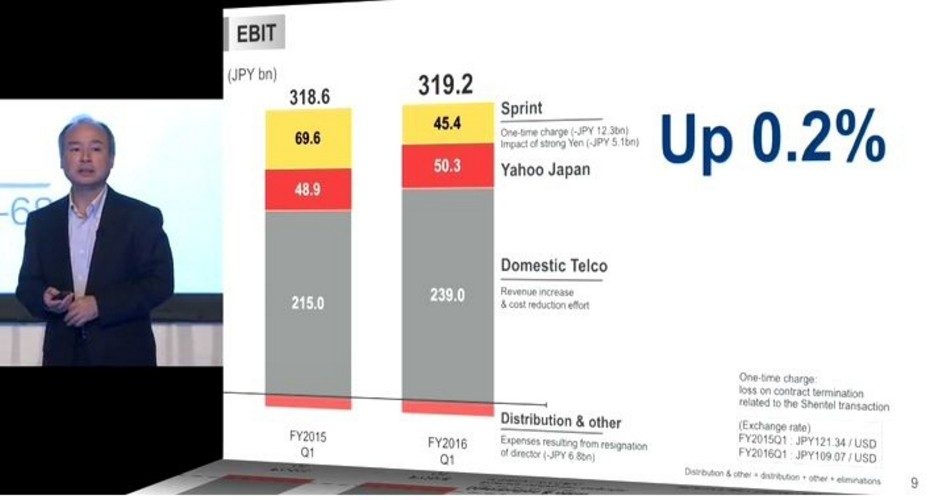

On that news, shares of SoftBank, a Japanese multinational telecommunications giant founded by Son in 1981 (think Sprint and Yahoo, in which Son has invested heavily), were in such demand that trading had to be halted briefly to accommodate all the buy orders.

The $50 billion would come from a $100 billion venture capital fund that Son has put together with other international partners, but it’s only part of the plan. Insiders familiar with Son’s thinking say he wants to make acquisitions as large as another $30 billion. Plus there’s another $163 billion in outside venture capital waiting for a more favorable environment to be invested in the United States.

The writer concluded by observing that if Trump keeps his promises to reduce regulatory burdens on U.S. companies, “more and more companies are likely to be making ‘upside sensitivity plans’ to take advantage of them.”

Related articles:

Behind the Jobs Report: Weakness in Manufacturing, Transportation

U.S. Steel Latest to Bring Jobs Back to the United States

Ford Will Keep Producing Lincoln MKC in Kentucky; Trump Claims Victory