Federal Reserve Chairman Ben Bernanke declared this week that too much borrowing and spending will eventually destroy the nation’s economy. Of course, a number of others have made similar assertions all along, but coming from the Federal Reserve chairman, who has seemingly attempted to mislead the public on the state of the economy, it is a surprising declaration.

Appearing before the Senate Budget Committee, Chairman Bernanke said:

Sustained high rates of government borrowing would both drain funds away from private investment and increase our debt to foreigners, with adverse long-run effects on U.S. output, incomes, and standards of living. Moreover, diminishing investor confidence that deficits will be brought under control would ultimately lead to sharply rising interest rates on government debt and, potentially, to broader financial turmoil. In a vicious circle, high and rising interest rates would cause debt-service payments on the federal debt to grow even faster, resulting in further increases in the debt-to-GDP ratio and making fiscal adjustment all the more difficult.

What Bernanke carefully failed to mention is that a good portion of that debt is owed to the Federal Reserve. CNBC reported in February:

That’s right, the biggest single holder of U.S. government debt is inside the United States and includes the Federal Reserve system and other intragovernmental holdings. Of this number, The Fed’s system of banks owns approximately $1.65 trillion in U.S. Treasury securities (as of January 2012), while other U.S. intragovernmental holdings — which include large funds such as the Medicare Trust Fund and the Social Security Trust Fund — hold the rest.

In August, Texas congressman and GOP presidential candidate Ron Paul introduced H.R. 2768, legislation designed to cancel the $1.6 trillion in debt. “I would say that is not a real debt. It’s a fictitious debt. It’s a dishonest debt, and that we’re not obligated,” he said. Unfortunately, Paul’s bill disappeared in a congressional committee.

And while Bernanke is suddenly sounding like a fiscal conservative, the underlying contributing factor to the U.S. debt and economic plight is the Federal Reserve and the nation’s monetary policies. Ron Paul said as much before the House Committee on Financial Services Subcommittee on Domestic Monetary Policy last year.

“Without the Fed’s relentless expansion of the money supply during both the Greenspan and Bernanke eras, the U.S. Treasury never would have been able to issue the staggering sums of debt that now threaten our economic well being,” Paul explained. “This Treasury debt is the very lifeblood of deficit spending, permitting one Congress after another to spend far more than the Treasury collects in taxes. It is precisely this unholy alliance between the enabling Fed and a spendthrift Congress that I hope our witnesses will address today.”

The Fed’s monetary policies are creating a cyclical problem for the economy. In order to pay off the massive debt, the Federal Reserve will print more money. And the definition of inflation is an increase in the amount of currency. (A rise in prices is simply an effect of inflation.) Increased inflation destroys the American middle class and negatively impacts the living standards of all Americans.

Even worse is that while it is known that the Federal Reserve has been printing money and inflating the dollar, very little is known about the details associated with the Fed’s handling of the money.

When Bernanke was asked by Senator Bernie Sanders (I-Vt.) during a March 2009 Senate budget meeting what the Fed has been doing with the American people’s money, he sidestepped the question.

Sanders said:

We have spent a lot of time in Congress talking about the $700 billion TARP bailout…. Not a whole lot has been talked about with regard to the $2.2 trillion that the Fed has lent out. Now I find that absolutely extraordinary that I wrote you a letter and I said, ‘Hey, who did you lend the money to? What were the terms of those loans? How can my constituents in Vermont get some of that money? Who makes the decisions? Do you guys sit around in a room? Do you make it? Are there conflicts of interest?’ So my question to you is, will you tell the American people to whom you lent $2.2 trillion of their dollars? Will you tell us who got that money and what the terms are of those agreements?

To that Bernanke responded, “Any bank that has access to the U.S. Federal Reserve system.”

Sanders asked for the names of the banks, but Bernanke refused to submit any because he claimed it “is counterproductive and will destroy the value of the program…. Banks will not come to the Federal Reserve.”

Sanders grew angry at that response and said, “Well isn’t that too bad. In other words, they took the money, but they don’t want to be public about who received it.”

The dialogue continued for several minutes, but in the end, no specific information was revealed regarding the exchanges between the Federal Reserve and the recipients of its funds.

That sort of secrecy prompted Ron Paul to introduce his Audit the Fed bill years ago, but it was voted down 229 to 198.

Paul, an outspoken opponent of the Federal Reserve throughout his tenure in office, said in 2002 of the quasi-private agency,

Since the creation of the Federal Reserve, middle and working-class Americans have been victimized by a boom-and-bust monetary policy. In addition, most Americans have suffered a steadily eroding purchasing power because of the Federal Reserve’s inflationary policies. This represents a real, if hidden, tax imposed on the American people.

Paul has often addressed how the Federal Reserve continues to serve the needs of a few, while imposing negative consequences on the average American:

Though the Federal Reserve policy harms the average American, it benefits those in a position to take advantage of the cycles in monetary policy. The main beneficiaries are those who receive access to artificially inflated money and/or credit before the inflationary effects of the policy impact the entire economy. Federal Reserve policies also benefit big spending politicians who use the inflated currency created by the Fed to hide the true costs of the welfare-warfare state. It is time for Congress to put the interests of the American people ahead of the special interests and their own appetite for big government.

Above all, Paul notes that the Federal Reserve is an unconstitutional establishment that has ultimately stripped Congress of powers that were assigned to it by the Constitution:

Abolishing the Federal Reserve will allow Congress to reassert its constitutional authority over monetary policy. The United States Constitution grants to Congress the authority to coin money and regulate the value of the currency. The Constitution does not give Congress the authority to delegate control over monetary policy to a central bank. Furthermore, the Constitution certainly does not empower the federal government to erode the American standard of living via an inflationary monetary policy.

According to Paul, it is the policies of the Federal Reserve that have driven people to the Wall Street protests. “It is no wonder they are up on Wall Street raising Cain because they know the system is biased against the average person.”

So when Bernanke says, “The heavy human and economic costs of the crisis underscore the importance of taking all necessary steps to avoid a repeat of the events of the past few years,” as he did this week in a speech at Stone Mountain, Georgia, critics wonder if he is referring to mistakes such as entrusting the Federal Reserve with the monopolistic responsibility of handling America’s money.

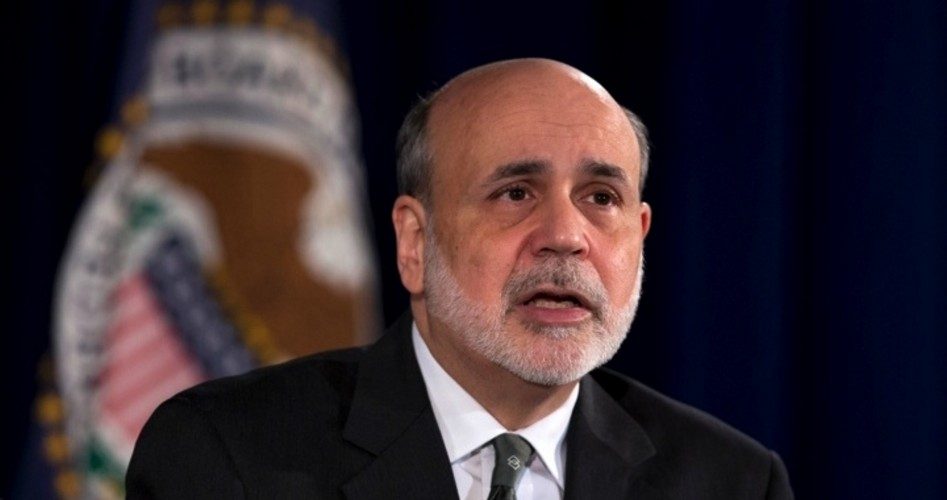

Photo of Federal Reserve Chairman Ben Bernanke: Federal Reserve