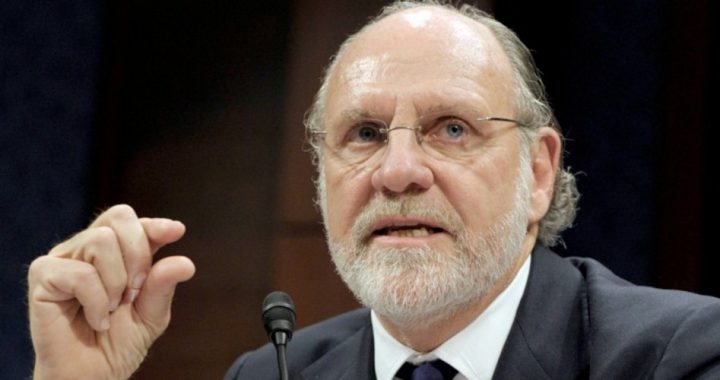

When James Giddens, the bankruptcy trustee who is liquidating the derivatives trading firm MF Global, filed his 275-page report on Monday, he said there may be enough evidence to file charges against the company and its former CEO (and former New Jersey Governor), Jon Corzine:

My investigation has concluded that management’s actions, along with the lack of sufficient monitoring and systems, resulted in customer property being used during the liquidity crisis to fund the extraordinary liquidity drains elsewhere in the business, including margin calls on European sovereign debt positions.

In light of these conclusions, I have determined there may be valid claims against individuals and entities. In my capacity as Trustee, I will make every effort to ensure that such claims result in the greatest possible returns to customers in an efficient and fair manner, whether those claims are pursued by my office or others.

The operative word here is “may” because the trustee doesn’t have law-enforcement or regulatory powers over the company or its former executives. The report draws no conclusions about possible criminal liability or statutory violations. All he wants is to get as much money back for MF Global’s clients as possible, and then he is done.

Although some funds have been returned, thanks to JPMorgan’s return of “excess” collateral held by the bank for MF Global, most customers are waiting to be made whole, and they may wait a long time.

The amount of money missing from customers’ accounts is estimated to be about $1.6 billion, most of which was used to back up a failed highly leveraged bet on the sovereign debt of several European countries, including Italy, Spain, Belgium, Portugal, and Ireland. That debt was supposed to be safe from market fluctuations while generating an increasing flow of interest to the firm. When the bet turned south and MF Global began to suffer margin calls, the company covered the calls with “hypothecated” funds from customers’ accounts. The game was over when MF Global ran out of customers’ money.

It’s this “hypothecation” language built into every customer’s agreement that is likely to save Corzine from spending a single minute behind bars. As explained by Christopher Elias, writing for Reuters,

If anyone thought you couldn’t have your cake and eat it too in the world of finance, MF Global shows how you can have your cake, eat it, eat someone else’s cake and then let your clients pick up the bill.

Here is that clause from MF Global’s customer agreement:

7. Consent To Loan Or Pledge: You hereby grant us the right, in accordance with Applicable Law, to borrow, pledge, repledge, transfer, hypothecate, rehypothecate, loan, or invest any of the Collateral, including, without limitation, utilizing the Collateral to purchase or sell securities pursuant to repurchase agreements [repos] or reverse repurchase agreements with any party, in each case without notice to you, and we shall have no obligation to retain a like amount of similar Collateral in our possession and control.

In simple English every customer agreed, in advance, to allow MF Global to use any of their money, including funds that they thought were safely resting in a money market fund, for virtually any purpose.

Claims to the contrary notwithstanding, Jon Corzine’s cozy relationship with the Obama administration (Jon Corzine is “our Wall Street guy” said the President) and the willingness of his company’s former treasurer, Edith O’Brien, to plead the Fifth Amendment during a congressional hearing on the matter, have put enough roadblocks in front of any successful restoration of those funds to its rightful owners. The “hypothecation” clause each of them signed is simply the one most likely to keep Corzine and his cronies free from serving time.

It was back in April when James Koutoulas, an attorney representing MF Global’s customers, said: “Crimes have been committed here without a doubt. We think there are enough facts out here to start arresting people and start filing charges.” As of this writing, no charges have been filed against anyone, nor are any charges likely to be filed.

On Wall Street, it’s called business as usual.

Photo of Jon Corzine: AP Images