Since the election in November 2010, there’s been plenty of talk about cutting the federal budget. The Cato Institute, for example, has come up with a $1.056 trillion proposal to cut federal spending. Newly elected U.S. Senator Rand Paul (R-Ky.) proposes to cut $500 billion from the federal budget. Other Republicans are now vacillating over whether or not to fulfill their campaign promise (“Pledge to America”) of at least $100 billion in budget cuts.

However, none of these budget-cutting proposals will actually balance the federal budget. Using the statistics of fiscal 2010, which are more difficult to fudge than budgetary figures for the current and future fiscal years, here are the relevant macro-economic numbers for 2010 federal spending and revenue:

For fiscal 2010, Congress planned to spend $3.721 trillion. But federal revenue was only $2.165 trillion. Which means that in order to match spending with revenue, it would have been necessary to cut . . . wait for it . . . $1.556 trillion of planned federal spending.

Notwithstanding any recent executive branch attempts to manipulate statistics in order to shrink the gap between spending and revenue, this gap is unlikely to have changed significantly for fiscal 2011, and so the budget-cutting proposals of the Cato Institute ($1.056 trillion), U.S. Senator Rand Paul (R-Ky.) ($500 billion), and the Republican Party ($100 billion) simply aren’t large enough to match spending with revenue. The yawning gap between spending and revenue is like the proverbial elephant in the room: Generally speaking, no one wants to talk about it, even though everyone is aware of its presence.

If we are going to take back control of our Constitutional Republic — without raising the national debt ceiling, and before our economy is overwhelmed by the delayed, tsunami-like effects of the Federal Reserve’s hyper-inflation of our paper currency from 2008 to the present — we will have to cut the proportional equivalent of $1.556 trillion per year during the remainder of this fiscal year’s federal budget.

What to do? The longer we put off the painful task of matching spending with revenue, the more painful it will be. In other words, NOW is the best possible time to stop the downward spiral toward national bankruptcy — before our economy collapses, and before we lose our national sovereignty. Remember, the basket-case countries currently making headlines in Europe had many opportunities to balance their budgets, but they chose repeatedly to put it off, to kick the can down the road — now look where they are.

According to Arthur Thompson, CEO of The John Birch Society:

In order to cut the federal budget, we must follow the Constitution. Ultimately, we need to eliminate all those departments not provided for in the Constitution. Starting now, even if deep cuts seem to be politically incorrect, at least we can begin rolling back government expenditures in [reverse] chronological order [with the most recent federal programs to be cut first].

But do our public servants have the will to do it? They may not want to, but it is necessary. This is not going to be pleasant in the short run, but it will be good for the country. As government is cut back and the economy grows, former government employees will soon find jobs in the growing private sector.

Starting with the $1.056 trillion Cato Institute proposal for spending cuts, we are still short $550 billion in cuts before we can match federal spending with revenue. Where to cut? I propose cutting more from Defense and Health and Human Services. [Education, Housing & Urban Development, and Transportation have either been completely or mostly eliminated in the $1.056 trillion Cato Institute proposal for cutting the federal budget.]

The $700 billion Defense budget can and should be cut in half, to $350 billion. That’s $200 billion more than the Cato Institute proposal of $150 billion.

Recognizing the vital necessity of defending our nation, our Founding Fathers gave Congress the enumerated power to raise military forces for that purpose. BUT, Presidents George Washington and Thomas Jefferson both warned the nation to avoid what Jefferson called “entangling alliances.” We were expected to use our armed forces primarily for defensive purposes. However, at least since World War I, we have entangled ourselves in foreign affairs to such an extent that we are now fighting two undeclared (and hence unconstitutional) wars, and we spend another large chunk of the Defense budget on maintaining overseas bases, most of which are used to enforce unconstitutional United Nation’s mandates, as well as unconstitutional “executive agreements” over which Congress has yet to exercise its constitutional oversight.

To realign our federal government with the Constitution in accordance with the original intention of the Founders, we need to withdraw from the two unconstitutional wars immediately, withdraw from the U.N. and other related organizations, forsake the unconstitutional practice of nation-building in foreign countries, and institute an orderly, strategic withdrawal from many, if not most, of our overseas bases as Congress begins to reassert its constitutional oversight over the executive branch.

In a speech at CPAC in 2008, Presidential Candidate Ron Paul (R-Texas) asserted, “We spend a trillion dollars a year maintaining an empire.” If the Defense Department budget in 2008 was roughly $600 billion, how did he come up with the $1 trillion figure? While the part of the Defense Department budget that is spent on our questionable “entangling alliances” was certainly less than the total $600 billion Defense budget, Ron Paul was also taking into account numerous federal foreign-aid and subsidy programs that benefit foreign countries, international organizations, and American businesses that either compete against foreign businesses or that do business in foreign countries. These unconstitutional programs originating in other federal departments (— e.g., State, Agriculture, Commerce, etc.), together with that part of the Defense budget used to fund our unconstitutional “entangling alliances,” could easily have added up to more than $1 trillion in 2008. However, the much more specific Cato Institute proposal for cutting $1.056 trillion from the entire federal budget already takes into account many, if not most, of the unspecified cuts in non-Defense spending that Ron Paul was suggesting with his $1 trillion figure. And it should be clear that there is certainly no constitutional justification for simply zeroing out the Defense budget.

Focusing specifically on the Defense Department, how should we cut the Defense budget by $350 billion? Not by cutting the pay or benefits of our military personnel, but by offering early honorable discharge from their tours of duty, in such a way that about half of our military personnel remain in active service to defend our nation and (finally!) to defend our own land borders. Also, as we are withdrawing from the two undeclared wars and systematically standing down from most of our overseas bases, the procurement of war materiel can and should be cut in half. And we can attain further savings by instituting more cost-effective procurement procedures (hat tip, Bob Vanasse) and by exercising more stringent congressional oversight over the Defense Department.

By disentangling ourselves from foreign affairs as much as possible, we can easily cut the Defense budget in half. To those who argue:

“No! We must hold on to all of those overseas bases and continue fighting two undeclared wars while nation building in somebody ELSE’s nation.”

I say:

- We’re spending ourselves into bankruptcy. Not only are these glorious military adventures unconstitutional, they are unwise and . . . what’s that word? . . . un-sus-tain-able.

- Oh, but we can’t stand down. For our national security, it is absolutely necessary to retain our global power and follow U.N. mandates.

- Really? And you probably also believe that World Wars I and II were necessary? For those who believe that, I suggest that you read a profoundly insightful book about events leading up to and occurring throughout the “World War” period – Churchill, Hitler, and the Unnecessary War (subtitled: How Britain Lost Its Empire and the West Lost the World) by Patrick Buchanan.

Thus far, in our search for $550 billion of cuts beyond the $1.056 trillion Cato Institute proposal, we have found $200 billion, but we still have $350 billion to go.

The $870 billion Health & Human Services (mostly Medicare and Medicaid) is the primary cause of rising medical costs. Whenever the federal government injects huge amounts of money into any sector of the economy, prices in that sector always go up. Medicare is the most upside-down, with Medicare patients receiving, on average, THREE TIMES more than what they paid into Medicare through paycheck deductions!

This monstrosity of a federal department is not only unconstitutional, but it is also . . . un-sus-tain-able.

So, what should we do?

Solution: Design a way to offer all Americans who have paid into Medicare a full refund, in inflation-adjusted dollars, for all of the Medicare deductions they have paid. Many older Americans might choose to stay in the current Medicare program. Many younger and middle-aged Americans would take the buy-out and then invest that money as they see fit. Some might invest most of the refund in private insurance policies (which is the way most people should have been providing for their own medical needs all along) while others might spend part of that refund on their own individual health maintenance measures (a necessary skill, these days). But the pipe dream of an idea that most of our grandparents bought into — the idea that the federal government would always be there to take care of our medical needs — would be rejected, hopefully forever. This buy-out will ensure that federal programs involving HHS deductions will be placed on a pathway to ultimate extinction, which is absolutely necessary if we are to restore our Constitutional Republic.

But what about cutting $350 billion from the current HHS budget in order to match federal spending with revenue?

In the non-Medicare/Medicaid part of the HHS budget ($142 billion), the Cato Institute proposal has already identified $81 billion of cuts from HHS. The other $61 billion in the non-Medicare/Medicaid part of the HHS budget can and should also be cut. Still, we need to find a total of $350 billion more in cuts.

Together, Medicare and Medicaid account for $726 billion of HHS expenditures. To match federal revenue with federal spending, Medicare and Medicaid expenditures need to be cut in half to $363 billion. Medicare recipients will have to understand that they cannot receive, on average, three times more than they have paid into the system, and so cuts are not only necessary but also justified. Higher age-eligibility limits, higher deductibles, larger co-pays, limits on lifetime total payout – it’s simply no longer possible for the federal government to give out “free” health care. Remember: We’re spending ourselves into bankruptcy. Appropriately limited Medicare benefits will be paid out only to recipients who choose to stay in the system and forgo the offered refund. States will have to understand that federal Medicaid payments are being cut in half this year, and could be terminated as soon as next year, and they need to plan accordingly.

So — $61 billion from the non-Medicare/Medicaid part of the HHS budget, plus $363 billion from Medicare/Medicaid adds up to $424 billion – but that’s more than the required $350 billion to balance the federal budget. What to do with the extra $74 billion? Use that to pay out Medicare refunds to those who want to take their Medicare deductions back in a lump sum, to stop paying any more in Medicare taxes, and to forgo any more Medicare benefits. The refund program will have to be calibrated gradually to shrink the Medicare tax base slowly enough that it can still pay for the appropriately limited benefits of all living Medicare recipients, but Medicare itself can eventually be eliminated with the last voluntary Medicare recipient.

$1.556 trillion per year — that’s approximately how much the federal government is planning to spend above and beyond expected federal revenue during this fiscal year. And to stay under the national debt limit, we must cut monthly spending by a proportional amount in order to regain control of our federal budget.

If we don’t insist that Congress make these proportional monthly cuts, then within two or three months, we will reach the national debt limit . . .

But perhaps even more urgent is this: On or around February 14th — St. Valentine’s Day, just 3 days away! — House Majority Leader Eric Cantor (R-Va.) has decided to schedule a vote on the level of federal funding for the rest of fiscal 2011.

Contrary to the usual standards of congressional procedure, the recently ended 111th Congress never managed to pass a formal budget for fiscal 2011 (the current fiscal year, which lasts until September 30, 2011). During the 2010 lame-duck session, because it had been unable to pass a budget during the regular session, Congress voted to continue federal spending at then-current levels until March 4, 2011.

Anticipating that deadline, House Majority Leader Eric Cantor (R-Va.) has scheduled a House vote on or around February 14th to decide how to spend federal revenue during the remainder of fiscal 2011. Cantor may expect House Republicans to support a continuing resolution for federal spending at, or close to, current spending levels. Such a continuing resolution would almost certainly put any further budget cuts off-limits for the remainder of this fiscal year (2011), thereby preventing the budget cuts that are necessary to match federal spending with revenue right now, and automatically necessitating the raising of the national debt limit so that deficit federal spending can continue and so that Congress can be relieved from the pressure of arguing about serious budget cuts until some time in the future – but not right now. You can be sure that the House Republican leadership will also promise to try really hard to match federal spending with revenue – in the next fiscal year (2012), which starts on October 1, 2011.

The House Appropriations Committee, under the leadership of Chairman Hal Rogers, is writing the continuing resolution. The headline of a February 10, 2011 press release clearly indicates their intentions with regard to fiscal 2011: “ROGERS ANNOUNCES INTENT TO CUT $100 BILLION IN THE CONTINUING RESOLUTION.”

In other words, they intend to cut no more than $100 billion for the remainder of fiscal 2011.

NOW is the time to instruct your U.S. Representative to vote against any continuing resolution that leaves the current level of federal spending largely intact, that necessitates raising the national debt limit, and that puts off, until some time in the future, the annualized $1.556 trillion of budget cuts that are necessary in order to match federal spending with revenue.

As we engage in the “eternal vigilance” that is necessary to manage our public servants so they will match federal spending with revenue, we need to keep foremost in mind the ultimate consequence of continuing success or continuing failure in our efforts to balance the federal budget:

Do “We the People” want to preserve our Constitutional Republic? Or do we want to become the slaves of the bankers who will gladly create more paper money for us, if we raise the national debt limit?

Related articles

Obama’s Spending Cuts Use Scalpel Where Ax Is Needed

Military-industrial Spending Spree

Bernanke Issues Warnings, Accepts No Blame

Chairman Ron Paul to Tackle the Fed and Jobs

Financial Crisis Inquiry Commission Report: Classic Misdirection

Myth: The Sky Will Fall if the Debt Ceiling Isn’t Raised

Must We Raise the National Debt Ceiling?

House GOP Leaders Mount Challenge to Debt Increase

House Republicans Consider Privatizing Medicare

When You Know You’re Bankrupt …

CBO to Congress: Spending & Debt “Unsustainable”

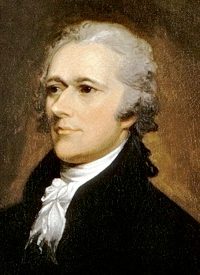

Portrait: Alexander Hamilton, First Secretary of the United States Treasury