The recent decision by Federal Reserve Chairman Ben Bernanke to begin holding press conferences may be one more indication of the increased influence of Representative Ron Paul (R-Texas). The Federal Reserve has long ignored the public and conducted its proceedings in cloister, but the Wall Street Journal reported April 21 that Bernanke will hold the Fed's first scheduled press conference ever after Wednesday April 27 Open Market Committee meeting.

The meeting will determine changes, if any, in Federal Reserve target interest rates and the fate of the "quantitative easing" program of the Federal Reserve to purchase some $600 billion in U.S. government debt securities by June. Most observers expect interest rates — currently set at historic lows, nearly zero — and the quantitative easing program to continue as scheduled.

The decision to hold a press conference conflicts with nearly a century of Federal Reserve operational secrecy. "Twenty years ago," the Wall Street Journal reported April 21, "the central bank didn't even tell the public when it was changing interest rates. Well-paid Fed watchers on Wall Street had to read the tea leaves and figure it out for themselves. Mr. Bernanke's predecessor, Alan Greenspan, conducted one on-the-record television interview shortly before the 1987 stock-market crash and never did another." As recently as 2009, Bernanke told then-Representative Alan Grayson (D-Florida) that he didn't know where some $500 billion in in Federal Reserve credit to foreign banks had gone, and that he would not reveal the information to congressional committees. But the press conference change is occurring just as polling numbers published by the Gallup track increasing distrust of the Federal Reserve's decisions among the American public. For the first time in recent memory, more Americans distrust the Federal Reserve Bank's decision-making than trust it.

This distrust is in part a result of the economic performance of the nation in recent years, but also must be partially chalked up to the persistent critique by Representative Ron Paul, the new Chairman of the House Monetary Policy Subcommittee. Paul has authored a best-selling book calling for abolition of the Fed, End the Fed, and has begun hearings that have exposed Federal Reserve policies that are responsible for the unprecedented rise in commodities prices in recent months.

Rep. Paul has been at the forefront of advocating a return to the gold standard at a time when gold has surpassed $1,500 per ounce, and other commodities such as silver, platinum, palladium, copper and oil have risen to record or near-record heights. In addition, some market analysts such as Standard and Poors have suggested U.S. fiscal and financial policy may merit downgrading the U.S. government's top AAA credit rating.

Representative Paul has been on the forefront of attempting to get transparency in Federal Reserve actions, and the decision by Bernanke may be an effort to preempt Paul's legislation and to conduct a public relations campaign to restore the public image of the nation's central bank. Last year, Rep. Paul's Federal Reserve Transparency Act, which called for a full audit of the Fed by the Government Accountability Office, garnered a full two-thirds of the U.S. House as cosponsors. A watered-down version of it (then it was H.R. 1207) passed into law. This year his Federal Reserve Transparency Act (H.R. 459) already garnered 131 cosponsors in the House and identical legislation has been introduced in the Senate by Dr. Paul's son, Kentucky Senator Rand Paul (R-Kentucky).

Bernanke's press conference will also have to deal with market critics of Fed policy, many of whom have declared that the Fed's ability to cheaply finance federal government borrowing are coming to an end. "At some point along the line, people are going to realize it's absurd to lend money to the United States government for 30 years in U.S. dollars at 3 or 4 or 5 or 6 percent interest," legendary investor Jim Rogers told Reuters. "The market is just going to give up." Rogers has predicted an "higher interest rates, higher inflation, lower U.S. dollar, currency turmoil" in the U.S. economy as a result of the Federal Reserve's inflationary quantitative easing program and suppression of interest rates.

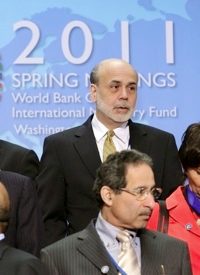

Photo: U.S. Federal Reserve Chairman Ben Bernanke, top center, joins other delegates at the International Monetary and Financial Committee (IMFC) at the spring meetings of the IMF/World Bank in Washington, April 16, 2011.: AP Images