Not only does President Barack Obama’s budget, released Monday, fail to make any real progress in spending cuts, but it reveals a frightening truth: the current fiscal year is on its way toward a federal deficit that will surpass the size of the total U.S. economy.

The Washington Times writes: "Mr. Obama’s budget projects that 2011 will see the biggest one-year debt jump in history, or nearly $2 trillion, to reach $15.476 trillion by Sept. 30, the end of the fiscal year. That would be 103.6 percent of GDP — the first time since World War II that dubious figure has been reached."

Furthermore, the government’s 2010 deficit reached $1.645 trillion, $230 billion more than that of 2009. To emphasize just how staggering these figures are, note that the deficit in 2007 was a "mere" $160 billion.

As noted by economists Carmen Reinhart and Ken Rogoff, when a nation’s gross debt passes 90 percent of GDP, it has a negative impact on the country’s overall economic growth.

According to the Washington Times, government measures debt in a variety of ways:

Debt held by the public includes the money borrowed from Social Security’s trust fund. Actual debt held by the public will reach 72 percent of GDP in 2011 and will climb as the Social Security trust fund’s finances continue to deteriorate.

Republicans have criticized President Obama’s failure to propose spending cuts that would adequately address the vast size of the national debt.

Senator Lamar Alexander commented, “I still don’t see a sense of urgency from the president about the massive federal debt. His budget calls for too much government borrowing — even though the debt is already at a level that makes it harder to create private-sector jobs.”

Naturally, White House Budget Director Jacob Lew indicates that the current administration’s role is simply to stabilize the economy by 2015:

The government will no longer be adding to our debts, and as a share of the economy, we’re going to stabilize the deficit. We’ll, in short, be paying for what we spend every year. The goal, to put it simply, is for the deficit to be in the range of 3 percent of our economy by the middle of the decade.

Apparently, there is a bit of logic to Lew’s assertions, though not much. The national debt is expected to be at 106 percent of GDP in 2013 and then reduce to 105.2 percent in 2015 and 2016, pending an economic boom. Unfortunately, according to the Congressional Budget Office, any assumptions that an economic boom is on its way are optimistic, and in fact an economic recovery will be slow for years to come.

Experts also indicate that increased interest rates will have a negative impact on the recovery. Currently, the federal government is functioning at lower interest rates so that corporations and individuals can benefit from lower borrowing costs. However, these low interest rates cannot last.

Oklahoma Republican Senator Tom Coburn indicates that for every point the interest rate is increased, the government would be able to pay $140 billion a year on its debt.

In the article “Obama’s 2012 Budget: A “Down Payment” with No Money Down,” The New American’s Thomas Eddlem addresses a variety of issues with President Obama’s proposed budget that allegedly touts budget cuts:

Much of the "cuts" in the deficit within Obama's budget are based upon a huge tax increase, the expiration of the Bush-era tax cuts. The New York Times explained: "The deficit for the next fiscal year, 2012, is expected to be smaller by more than $500 billion, largely because of the expiration of those tax cuts and the two-year stimulus package that Mr. Obama signed into law soon after taking office." It's clearly not spending cuts that would trim the deficit. Obama's 2010 budget proposal planned for $3.662 trillion in spending in fiscal 2012, last years' budget proposal called for $3.755 trillion in fiscal 2012 spending, and this year's budget calls for $3.729 trillion in fiscal 2012 spending. In other words, the projected spending increases have remained largely static over two years, despite all the talk of "cuts.”

The budget for the next fiscal year is setting the stage for some contentious debate, even amongst Republicans. At this year’s Conservative Political Action Conference, Senator Rand Paul (R-Ky.) asserted that the GOP proposal to return to 2008 spending levels is “not bold enough.” He explained that instead, the federal government can save a great deal of money by eliminating unconstitutional programs such as the Department of Education.

Without true fiscal conservatism, the future of the American economy is certainly bleak.

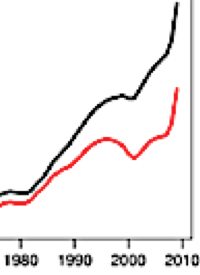

Graph: U.S. debt curves upward from 1980 to 2009. Red lines indicate the net public debt and black lines indicate the gross public debt.