By popular measures, the U.S. economy is in the midst of one of the longest economic recoveries in its history. After all, the current economic expansion — now 85 months and counting — is the fourth-longest since 1857. As reported by the Bureau of Labor Statistics, the U3 unemployment rate was 4.9 percent in July, less than half the level seen during the depths of the Great Recession. Meanwhile, the housing market is booming and the stock markets are hovering near their all-time highs.

So why does the Real Clear Politics “Direction of Country” polling average indicate that Americans believe the United States is on the wrong track by a margin of more than 2:1? Quite simply, because it is.

Fundamental Analysis

In finance, the traditional means by which to determine the probable value of a stock is through fundamental analysis. Investopedia defines the term as follows:

Fundamental analysis is a method of evaluating a security in an attempt to measure its intrinsic value, by examining related economic, financial and other qualitative and quantitative factors. Fundamental analysts study anything that can affect the security’s value, including macroeconomic factors such as the overall economy and industry conditions, and microeconomic factors such as financial conditions and company management. The end goal of fundamental analysis is to produce a quantitative value that an investor can compare with a security’s current price, thus indicating whether the security is undervalued or overvalued.

{modulepos inner_text_ad}

Fundamental analysis can be incremental, exacting, and tedious, and frequently flies in the face of investor exuberance, but the process is critical. Without it, speculators tend to follow a herd mentality: Assets increasing in value must be worth buying. The faster things rise, the greater the demand.

Most people now understand the fallacy of this approach. The dot-com and real estate bubbles that dealt a one-two body blow to the economy were the result of irrational speculation despite a lack of fundamental support. There isn’t a person reading this article who wouldn’t agree with that assessment.

And yet, it’s happening again — right before our very eyes.

Low Interest Rates

To combat the last recession, the Federal Reserve performed a series of maneuvers in order to reduce interest rates to historic lows. Lower rates tend to spur demand for more expensive items such as cars and houses. And businesses are more apt to purchase big-ticket assets such as equipment and commercial real estate.

It worked. Once the lending freeze that gripped the financial services industry during the recession eventually thawed, credit began to reach Main Street. Car sales increased by 46.3 percent between 2009 and 2014, and new home sales reached a nine-year high just last month.

Here’s the problem: The appearance of strong demand is an illusion foisted upon the economy by near-zero interest rates. Rates cannot stay down forever, and when they finally rise (and if history is a guide, they could boomerang upward), demand is all but certain to dry up. With nearly 70 percent of the economy tied to consumer spending, that’s a really big deal.

Excessive Money Supply

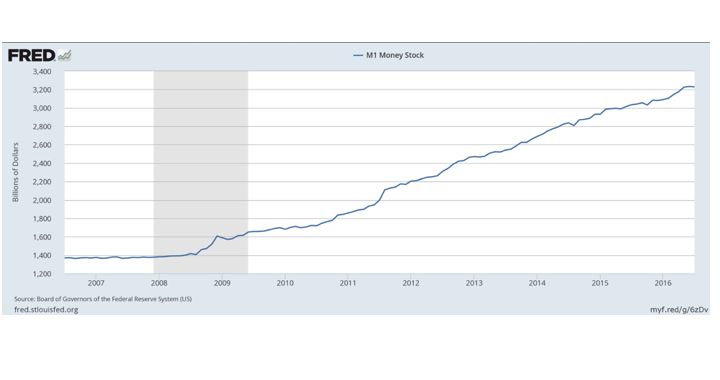

In concert with lowering interest rates, the Fed bought bonds and infused cash into the economy. Lots of cash. The table below shows just how much the M1 money supply has grown over the past 10 years:

All that money has to go somewhere. And it does: Banks lend it out, consumers and businesses spend it, and the economy is stimulated in the process. However, much like demand created by artificially low interest rates, the excessive cash sloshing around is a house of cards. Not only will its stimulative effects diminish once the money supply normalizes, but it has the propensity to trigger above-normal levels of inflation.

Those of us old enough to remember the 1970s era of stagflation during the Carter administration know that feeling all too well. Some argue it’s right around the corner.

Lack of Fiscal Discipline

America’s utter unwillingness to practice fiscal discipline is so pervasive that deficits are considered a fact of life. Over the past 76 years, just 12 saw the budget balanced, the last time being in 2001.

Although Dick Cheney once insisted that “deficits don’t matter,” that simply isn’t true. Deficit spending means the U.S. government loses money every year, and a business that consistently posts losses endangers its own existence.

The ballooning national debt is the net result of fiscal and monetary malfeasance, and although low interest rates mask the serious nature of the threat, that won’t last. Once interest rates begin marching upward, they could zoom out of control — in 1981, mortgage rates hit 18.5 percent — with the resulting rise in the percentage of the budget necessary to pay the interest potentially crippling the economy.

Funhouse Mirrors

The aforementioned factors may have served to help grow the economy over the past seven years, but much like a funhouse mirror, the image is badly distorted.

Gross domestic product may have grown, but at a rate less than two-thirds the post-WWII average. Jobs have rebounded somewhat and the official unemployment rate has diminished, but so has the Labor Force Participation Rate, meaning the official unemployment rate hides the fact that lots of Americans aren’t working. Adjusted for inflation, income has fallen. Worst of all, the biggest factors driving the recovery — low interest rates, a burgeoning money supply and debt, and deficit irresponsibility — are the metaphorical equivalent of a freight train about to jump the tracks. When it does, watch out.

The Day of Reckoning Is Coming

Damon Lindelof once wrote, “There is no suspense in inevitability.” We may not know when it will happen, but there is no question that the day of reckoning is coming.

The United States cannot continue to manipulate interest rates, the money supply, and the budget without serious consequences to its long-term economic health. The only solution is to allow market forces to take hold, impose fiscal and monetary discipline, take the resulting medicine and ride out the storm

The meager 1.2 percent growth in second quarter GDP may have landed with a resounding thud, but without the courage of convictions overcoming political cowardice, the bigger worry is that the next loud thumping sound will be the other shoe dropping on the economy.